With 2 million third-party sellers accounting for more than half of its retail revenue, Amazon’s relationship with the businesses that sell on its platform has become essential to its success. As those sellers have become more successful though, they have also become more powerful …and more demanding.

Many are no longer content to exist solely in a homogenized environment, cut off from the customers they sell to and the data those sales generate, even if that environment does offer massive reach and infrastructure. So Amazon is working on ways to let sellers have their cake and eat it too, with an ever-growing slate of new solutions that offer Amazon sellers more autonomy, but critically keeps them tied to the Amazon machine — even if it’s not specifically on Amazon.com.

To hear Amazon tell it, it’s all part of the natural evolution of what has been, undeniably, a paradigm-shattering existence. “For much of the history of retail, there have been significant barriers that put high hurdles in front of entrepreneurs who wanted to launch a new brand,” said Dharmesh Mehta, VP of Worldwide Selling Partner Services at Amazon during the third annual Accelerate conference for Amazon sellers.

“Together we have broken down so many of those barriers,” Mehta added. “Amazon provides brand owners with access to hundreds of millions of customers, our virtual store shelves and shopping experiences allow new and innovative brands to be discovered and to delight customers in a way that simply wasn’t possible even a short while ago. But it’s not just about removing historic or retail barriers. We’re confident that together we can do so much more to accelerate the success of brands by inventing new capabilities on your behalf.”

And one need look no further than those “new capabilities” to see where Amazon itself is headed next.

‘The Place Where Brands are Born‘

Amazon has established itself as The Everything Store; now it wants to be known as The Place Where Brands Come to be Born. In many ways it already is — according to Mehta more than 100,000 new brands launched on Amazon’s U.S. store last year. The problem comes when they get so successful that they want to go somewhere else — their own website, for example, or into a major national chain’s stores.

Never fear, Amazon has a solution for that — an ever-growing suite of them. Indeed, it appears that Amazon’s aim has shifted from wanting to be the place, to wanting to be the brand — one that enables innovation, creation, and most of all commerce, wherever it happens.

“One of the anecdotes I love most is when a brand that has been born on Amazon becomes very successful, gets a big following, and they make their way into a big chain, [one of the] traditional physical store retailers that we compete against,” said Doug Herrington, the newly appointed CEO of Worldwide Amazon Stores at the Accelerate conference. “I’ve actually had sellers come up and tell me about this and they were kind of sheepish about telling me about that last component, but I love it. I love it because it validates how well our brand-building environment works for sellers.”

The New ‘as-a-Service’ Frontier

As Herrington sees it, a good experience with the Amazon brand, whether it happens on Amazon.com or not, is a win. This kind of thinking goes against the traditional retail wisdom that you should keep your customer with you at all costs. And yet it’s not revolutionary at Amazon, which for years has been packaging its tech and selling it to retail competitors through services like Just Walk Out, its Amazon Connect contact center offering and its cloud services infrastructure.

The idea of bringing in extra cash by selling tech you’ve developed (or acquired) to solve your own business challenges is catching on, with a whole host of other retailers now getting into the “as-a-service” game, including Gap, American Eagle Outfitters, ThredUP and Instacart.

But what Amazon is doing now with its sellers is different. New offerings unveiled at Accelerate will help Amazon sellers:

- Deliver better experiences on their DTC site;

- More efficiently warehouse and ship product across all their selling channels, even if that means other marketplaces or brick-and-mortar retailers; and

- Drive customers from Amazon to their owned channels to make a purchase.

Much of this would be anathema to other marketplaces and retailers. After all, what’s the point of existing at all if the conversion isn’t happening with you?

Helping Amazon Sellers Sell Off Amazon

The prime example of this is Buy with Prime. Launched in April 2022, Buy with Prime lets sellers that also operate a DTC site offer all the benefits of Prime membership (simplified payment processing, fast delivery, easy returns) directly from their own website. That means, unlike in the walled garden of Amazon.com, those brands also get to own all that customer intel within a fully branded environment (not to mention the higher margins) while still delivering an Amazon-level experience. If those brands are also Fulfillment by Amazon (FBA) customers, then those benefits transfer as well: even though the sale happens on the brand’s site, Amazon will handle storage, packing and delivery. (All of this is offered for a fee, of course.)

“There was some head scratching by people when we announced this,” said Herrington. “They said, ‘Isn’t this going to cause some people that would shop on Amazon to shop off of Amazon?,’ and the honest answer is, maybe. But what we know is that it’s going to be a better customer experience for Prime members. And if we have happy Prime members who are enjoying free, fast shipping, on Amazon and off Amazon, that’s going to be happy customers, that’s going to be happy sellers, and it’s going to be great for all of us.”

A head scratcher indeed, but when you consider Amazon’s history of deviating from tradition — which most of the time has ultimately benefited the company enormously — it starts to seem like something to take seriously. Shopify, one of Amazon’s fiercest competitors in the ”SMB enabler” space, certainly is, warning its clients that using Buy with Prime violates their terms of service.

For their part, Amazon sellers seem to love Buy with Prime. Epic Water Filters said it’s seen conversion increase 40% on its site since adding Buy with Prime. “I’ve always looked at our website as our headquarters, but we’re a small brand, we can’t afford to deliver in one to two days and we won’t do it effectively anyway,” said Aishetu Fatima Dozie, Founder and CEO of Bossy Cosmetics at Accelerate. “Being able to welcome customers to our site, keep them there, keep the data but then give them one- to two-day delivery was something we couldn’t pass up. Off Amazon, on Amazon, in-store, for us it’s all about convenience. We want our customer to be able to engage with our brand in a seamless fashion across all our different channels so we can meet her where it’s convenient for her and where she’s happiest shopping.”

And it doesn’t stop at the transaction. At Accelerate, Amazon debuted a whole host of services to help its sellers sell anywhere, including:

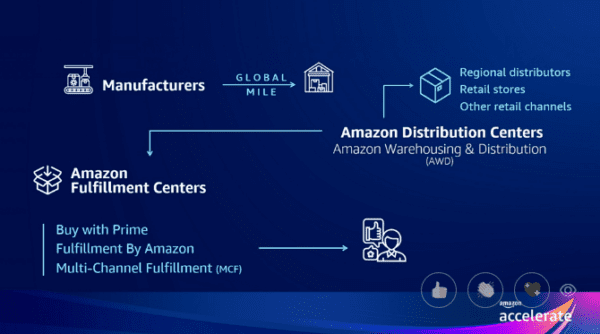

- Amazon Warehousing and Distribution (AWD) — a new upstream storage and distribution offering that lets sellers send their inventory in bulk to Amazon distribution centers where it can sit until it’s needed. AWD is, of course, integrated with Amazon fulfillment, so inventory will automatically be shipped to Amazon fulfillment centers when needed and, starting next year, that inventory can also be sent to other distribution channels, including wholesalers, regional distributors, other retailer warehouses or brick-and-mortar stores;

- AWD works in tandem with Multi-Channel Fulfillment (MFC), with Amazon consolidating and fulfilling seller orders from anywhere the sale happens, including on DTC sites and other marketplaces, in unbranded (i.e. no Amazon arrow on the box) packaging;

- A growing slate of local selling options enabling Amazon sellers to drive customers who live nearby to their physical stores for pickup, and also to fulfill online orders from those stores;

- A multi-channel shipping tool, Veeqo, that helps sellers coordinate inventory and shipping across all their online channels while accessing discounted rates at carriers. Amazon acquired Veeqo, which was developed by a former Amazon seller, in March 2022 and has now made the tool available for free to all U.S. sellers;

- Allowing brands more opportunities to connect with the customers they sell to on Amazon through the new “Tailored Audiences” offering. Previously sellers could only email customers who followed them on Amazon, but now they will be able to contact repeat customers from the past 12 months, high spenders and recent customers;

- Sponsored product or brand ads on Amazon that will lead directly to a brand’s DTC site rather than their page in Amazon (for Buy with Prime customers only though); and

- The opportunity to appear in Alexa answers by providing responses to questions relevant to your category. For example, a seller of pet hair removers can provide an answer like the following to the question, “Alexa, how can I remove pet hair from my carpet?” Answer: According to the seller Canine Friend, you can use a lint roller designed for pet hair removal. To remove pet hair from carpet, upholstery and furniture just roll our lint remover tool back and forth to trap pet hair and lint. See lint rollers from Canine Friend.

But Why?

But why would Amazon do this, that is, enable brands to sell more and better on other, in many cases competitive, channels? Herrington offered some insight at Accelerate: “We internally calculate downstream impact, or DSI, for almost everything that happens on Amazon,” he said. “Anything that we change has a short-term impact and a long term-impact on customer behavior. For instance, if we see that we have an uncompetitive price on a product, we can measure that customers are going to shop less with us in the moment. Interestingly, we also see that when a customer sees an uncompetitive price they will shop less with us over the next 365 days — that is our DSI.”

The DSI here must look good for Amazon, even if a portion of the sales these brands drive don’t happen on Amazon.com. In fact, when you step back and look at it, Amazon is effectively placing itself at the very center of all online commerce with these solutions, not to mention serving as the low-barrier entry point for new brands to emerge. As they mature, why wouldn’t those brands continue to use Amazon services even as the grow beyond Amazon.com?

In his opening remarks, Mehta shared a number of impressive facts: “Sellers in our U.S. store launched more than 100,000 new brands last year,” he said. “At the same time, existing U.S. sellers grew their sales by more than 25% over the previous year. Last year, there were more than 70,000 U.S. sellers who generated over $100,000 in annual sales in our store, and our sellers employed and provided jobs for more than 1.5 million people in this country.

“These numbers tell an impressive story, one that is driven by a flourishing partnership between Amazon and the many amazing entrepreneurs who sell in our store,” Mehta said. “It’s a partnership grounded in the fact that we will only succeed if all of you succeed, and so we’re constantly working to help drive your success. We’re working together to continue to write the story of the most successful partnership in the history of retail.”