For shoppers, paying for the items they want is a necessary evil at best and a complicated chore at worst (especially online). That inherent distaste for the transaction phase is one reason payment companies are so eager to expand into other parts of the shopper journey. McKinsey calls this embedded finance — when a financial product or solution is placed in a non-financial setting, for example on a social media platform or in a store (private label credit cards are one old-school example).

Embedded finance has become big business: McKinsey estimated that the sector reached $20 billion in revenue in the U.S. alone in 2021 and has the potential to double in the next three to five years.

With those kind of numbers in play, it’s no surprise that competition in the space is fierce, and retail is a central battleground. And with 50% of global spending in the U.S. taking place online, digital payment solutions like Venmo and PayPal (which has owned Venmo since 2013) are well positioned to capitalize on the opportunity.

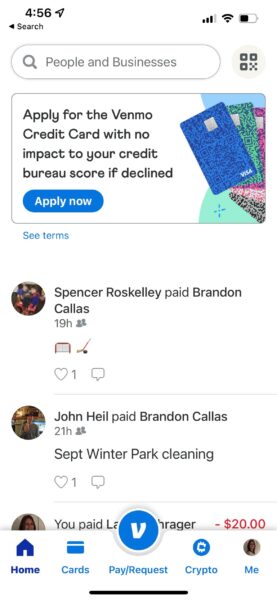

As other payment solutions differentiate with multi-retailer rewards programs, browser extensions and even creator marketplaces, Venmo is betting that what made it successful in the first place is also what will help it rise to the top of the embedded payments pile — community.

Denise Leonhard, VP and General Manager of Venmo, talked to Retail TouchPoints about what sets Venmo apart from its competitors (including PayPal) in this hotly contested space, and how the platform’s native social sharing features give it an edge.

Retail TouchPoints (RTP): The world of payments is actually a pretty exciting place right now — tell us how Venmo is capitalizing on all this momentum.

Denise Leonhard: Retailers have to go to all these different channels now, much more than they used to, and it’s not just about the products themselves — consumers are also looking for that seamless payment experience with the brands they trust. So Venmo has stepped in and provided two different products to help retailers both small and large be able to do this.

For the enterprise solutions we have Pay with Venmo checkout, which is the integrated checkout button that you see as you’re checking out with large businesses such as the Grubhubs and Lyfts of the world.

Then on the smaller side — for the solopreneurs, the casual sellers and users with a side hustle — we have Venmo business profiles. What that enables people to do is accept payments for goods and services and then also grow and market their business on the Venmo platform. Artists who are selling crafts at a fair, barbers serving up one-of-a-kind haircuts or the florist down the street are using these business profiles to interact on the Venmo platform and talk about all the great things they’re selling. We launched a little over a year ago, and already have 1.5 million small businesses with profiles.

It’s just so seamless and easy to accept Venmo, so people are using it and actually spending more. We’re seeing that shoppers are actually 19% more likely to complete a purchase with Venmo over traditional payment methods, and we’ve also found that Venmo users shop over 2X more frequently than the average shopper, and 19% are more likely to make repeat purchases.

For example, Pressed, a quick service restaurant that does juices, saw a 57% higher membership average order value through Venmo than with traditional credit cards. Our merchants are seeing higher conversion rates, and as a result we’re seeing a tremendous amount of volume growth within Venmo — 250% year over year.

RTP: How does this all fit within the larger PayPal ecosystem, especially where the two brands have similar offerings — do you ever find you’re competing with yourself?

Leonhard: The interesting thing about PayPal and Venmo is that the overlap of our consumer bases is not one-to-one. We actually have tens of millions of people who just have Venmo accounts. So the Pay with Venmo checkout button enables those tens of millions of folks that don’t have a PayPal account to be able to seamlessly check out with Venmo instead.

PayPal also has its own small business solutions, but [those business profiles] I mentioned sit solely in the Venmo platform. Also, because of the way Venmo profiles exist alongside the social feed, those are unique [attributes] that businesses can leverage to market within Venmo that you can’t necessarily do on PayPal.

RTP: What consumer payment trends are you tracking right now as you look to keep Venmo ahead of the curve?

Leonhard: (with a laugh) Sometimes I feel ancient because before PayPal I was at American Express, so I’ve spent over a decade thinking about this. What I think is most interesting right now is this social element happening with payments — in places like Instagram and TikTok, being able to seamlessly purchase the products that are being recommended and having those payment solutions feel really integrated. In these spaces you’re getting recommendations before and even after the purchase, so how all that is shaping up together I find really interesting.

There’s always an opportunity to make payments more seamless and easy as possible and make it feel like it’s part of the overall experience. Whether that’s on social platforms or at traditional retailers there’s still opportunity to be had there.

What I also find interesting is the verticals that are really taking off within Venmo. Where we’re seeing a ton of traction is in places like food delivery, so Grubhub, Uber Eats and DoorDash. We’re also seeing a lot of movement in travel — Uber, Lyfts, Booking.com, which is a new merchant for us — and around entertainment, so Ticketmaster, AMC, FanDuel, DraftKings. And then the last one is fashion, so for example Poshmark, Abercrombie & Fitch, Stitch Fix.

All these merchants that are trying to go after millennials and Gen Z really see the opportunity to tap into the Venmo consumer base in order to really capture them. There’s also a social sharing element to all of these categories that’s synonymous with Venmo. If you’re thinking about buying food with your roommates or splitting an Uber, that sharing and social aspect all starts to become a piece of the transaction as well.

RTP: Venmo’s roots are in peer-to-peer payments, and that’s still a big part of the business. As you move more into the enterprise space, serving brands and businesses, how do you balance the needs of these two very different client sets?

Leonhard: Whenever we go out and talk to our Venmo user base, the love that consumers have for Venmo just comes out in all the surveys. They talk about how simple and fun it is to use and that they want more ways to use Venmo, so these [business] solutions are an extension of that.

For example, I have a farmer’s market down the street that I go to every week. I know the vendors’ first names, they’re almost friends at this point. In many cases these small businesses become an extension of your friends and families, it’s the next layer of your local community, so it’s a very natural extension [for Venmo]. I mean, remember what a pain it was to have to get cash for the babysitter?

And then on the checkout side, our consumers were asking to be able to use Venmo in more places, to be able to use their balance, to be able to pay in other places seamlessly, so that was a natural extension for us as well.

RTP: We know that when retailers offer these more convenient payment solutions there are big payoffs in terms of conversion numbers and customer satisfaction, but there is a tipping point where too many options clutter up that transaction moment. With so much competition out there at the enterprise level, what is Venmo’s pitch to major retailers?

Leonhard: There are three things. One is that the Venmo community is now approaching 90 million consumers in the U.S. — one in three Americans have a Venmo account. We’re really a part of consumers’ everyday lives, so there’s a tremendous built-in audience. Secondly, what we’re also seeing is that shoppers are, again, 19% more likely to complete a purchase with Venmo over traditional payment methods. People really are converting at checkout because it’s seamless and easy. The third is all the great interaction that happens within the Venmo app, where you can see your purchases and share it out if you want to.

RTP: What is the ultimate goal of Venmo in the commerce landscape, especially with so much disruption happening right now?

Leonhard: Our number one goal is to be a really simple, easy way for people to not only pay their friends and family, but also their local businesses and the brands that they love. Basically giving consumers more opportunities to use Venmo.

And not just online. We have both a static and an integrated QRC (QR code) capability for merchants. The static is as simple as placards that you put in a store, at a market stand or even wear around your neck if you’re walking around selling, and it’s just a static QR that formalizes your business profile. And then we do have an integrated QRC solution that you can see in places like CVS, where you can purchase via PayPal or Venmo through an integrated QR.