Once largely associated with lower-income households, dollar stores are now becoming retail staples even for more affluent households, inspiring retailers in these categories to invest more heavily in marketing, merchandising and technology innovation that will help them differentiate.

This pivot has largely been driven by a more cautious and price-aware consumer: 80% of consumers indicate that the economy has slightly or significantly changed their shopping habits and behaviors, according to CI&T research. Additionally, high interest rates are a reality for the “foreseeable future,” which has “fundamentally changed the disposable income available to individuals,” according to Mohit Mohal, a Managing Director with Alvarez & Marsal’s Consumer and Retail Group. “That has ultimately had a trickle-down effect on the category.”

The Changing Face of the Dollar Store Shopper

Macroeconomic dynamics have fundamentally changed the “profile” of the dollar store shopper. Over the past five years, these retailers have seen their customers evolve to represent:

More diverse household incomes

Historically, dollar stores have had a core customer base of households with an annual income of $30,000 to $60,000, Mohal said in an interview with Retail TouchPoints. Their association with more rural and lower-income areas created a stigma among more middle-class and affluent consumers.

However, rising interest rates and the pressures of inflation have broadened dollar stores’ reach. “These sectors are now seeing a significant portion of traffic within the household income of $220,000 and under, because there is a significant amount of trading down that has happened,” Mohal said.

Additionally, the formation of millennial-run households is making dollar stores more central to consumers’ consideration sets. These shoppers, now between 28 and 43 years old, have become more frugal with retail purchases, noted Coresight Research analyst Sujeet Naik: “As the millennial cohort ages, their household formation rate will accelerate, reflecting more stable incomes and plans for marriage and children,” he said. “This increase in household formation will have a significant impact on millennials’ discretionary spending, as this demographic are already facing more financial constraints — such as high student loan debts and low assets — than previous generations such as baby boomers.”

A new perception of dollar-store shopping

Dollar stores have always been considered destinations for consumers who love the thrill of the hunt. “Discount shoppers often enjoy the process of hunting for bargains and take pride in finding the best deals,” said Naik in an interview with Retail TouchPoints. “They are ready to make frequent store visits to find a bargain and are willing to sift through messy displays.”

For some, that thrill is driven by saving money. For others, it’s about daring to mix-and-match lower-cost items with high-end products, showing off their ability to both save money and look stylish. “There’s this cool factor of being able to mix and match products from different brands,” noted Matt Katz, Managing Partner at management consulting firm SSA & Co. “It’s almost a badge of honor to throw on a designer item with an item you found in the thrift store or a discount store. That all creates positive momentum for these retailers.”

More frequent trips, smaller basket sizes

Households do not go to dollar stores once or twice a week to spend $200 per visit. “They will break their trips into multiple small trips with the average order value being between $15 and $20,” Mohit explained.

Part of the reason for this pattern is that dollar stores are numerous and fairly conveniently located, a result of these retailers’ increased investment in their brick-and-mortar footprints. “If you look at every single retail sub-sector and plot the number of store openings in the last decade, this segment has added between 45,000 and 50,000 stores in the last decade, while others have been reducing their footprints,” he said.

Expanded Assortment Helps Draw a More Diverse Customer Base

To effectively reach and resonate with a more diverse audience, dollar stores are focused on creating an easy and transparent experience for the customer. At a foundational level, that means having a simple pricing model.

“Discount shoppers prefer simplicity in pricing without hidden fees or complicated discounts,” Naik explained. “For example, Dollar Tree’s $1.25 pricing provides a clear and consistent perception and eliminates sticker shock.”

But dollar stores have strategically focused on expanding their merchandise mix and brand assortment, which has ultimately allowed them to break free from the $1 limit that has defined the category. “If you look in the refrigerated sections within any of these dollar stores, they’re [offering] $3, $4 and $5 items,” Mohit noted, part of a broader assortment architecture that includes traffic drivers, basket builders and gross margin maximizers.

Essentials such as bread and milk are primary traffic drivers, which inspires consumers to visit several times a week and have helped dollar stores tackle declining store visit rates. Integrating non-essential and higher-price point categories into their assortment allows these retailers to better engage and serve customers while they’re in stores.

For example, Dollar General has effectively expanded its assortment and curated the in-store experience to make the shopping journey more seamless. The retailer recently shared its progress in expanding its fresh food offerings and aims to structure stores based on customer needs and “moments.” The retailer also has started an entirely new concept, pOpshelf, designed to include a more diverse range of products across beauty, home décor, arts and crafts, and ultimately target a broader clientele.

“These retailers are very good at creating bespoke assortments; the assortment in New Hampshire is going to be different than the assortment in Arizona because the product availability in those markets will be different,” Katz explained. “It’s not just the consumer that’s driving product availability; they are really good at planning adjacencies of products and it’s a big area of differentiation.”

Tech Investments Always Connect to Convenience

At a psychographic level, dollar store shoppers have “forced the lines to blur between channels,” according to Katz. “There’s such great access to product information, product availability, pricing and feature functionality that this blurring isn’t just happening between brick-and-mortar and ecommerce; it’s happening at price levels and even service levels within retail environments.”

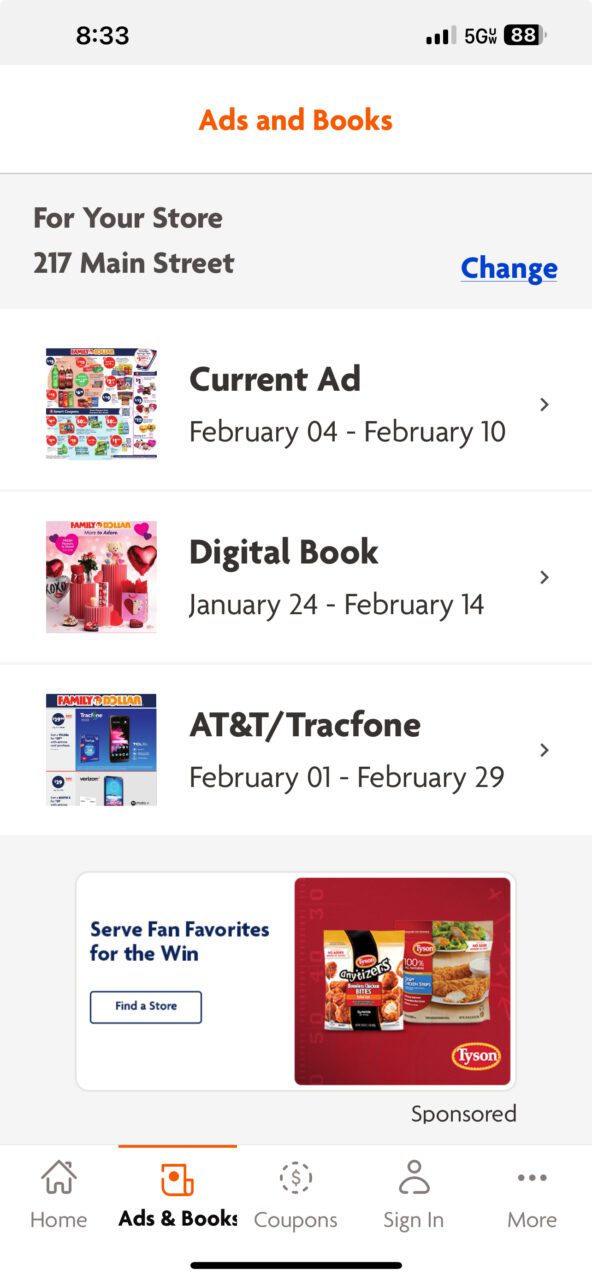

That is why dollar stores’ primary technology investments revolve around creating ease, access and convenience for consumers. Mobile apps have become a notable investment opportunity for these retailers, because they can inform consumers and empower them to make the best possible decisions.

For example, Family Dollar recently unveiled a new shopping app designed to help users manage coupons, explore weekly ads and easily locate products using intelligent search functionality. Dollar General has similar capabilities, in addition to a list-building function that allows users to easily track their savings.

“Some of these retailers are putting a lot more energy and innovation into their mobile apps than they are in their brick-and-mortar stores,” noted Melissa Minkow, Director of Retail Strategy for CI&T. “Because this shopper is more disciplined and on a budget, they’re likely using these apps to plan, so it’s important that they can really map out their spending.”

These apps also emphasize local inventory availability and the fulfillment experience, Minkow noted, something that many retailers lack in their app experiences: “They’re telling you stock levels at the numerical level and provide very specific delivery times,” she said. Apps also promote partnerships with third-party delivery partners. For example, the Family Dollar app heavily promotes same-day delivery services available via Instacart.

“There tends to be a misconception that discount shoppers are not very tech savvy or are indexing more towards brick-and-mortar, but the data is saying otherwise,” Minkow said. “This consumer is very tech savvy and using their smartphone to be extremely strategic with their spending.”