Editor’s Note: As 2023 comes to an end, we are highlighting some of our most-read content of the year. We look forward to continuing to deliver original, thought-provoking stories like this one to our readers in 2024.

“Omnichannel” has been an aspiration for brands for many years now, but while it used to refer to the merging of a retailer’s brick-and-mortar and ecommerce operations, it now means something very different. The “new omnichannel” that retailers now aspire to includes not just stores and websites but also social media, search engines and perhaps most importantly, multiple online marketplaces.

This was evident at Prosper Show in Las Vegas, March 13-15, 2023, an event originally developed for Amazon sellers. However, a shifting power dynamic became clear this year, driven by one simple fact — Amazon is no longer the only game in town. The last few years have seen a veritable explosion of online marketplaces, and a number of these are becoming sophisticated enough to challenge Amazon’s dominance. Brands, even those built on the back of Amazon, have choices now, and newer marketplace operators like Walmart are making a determined pitch to Amazon sellers.

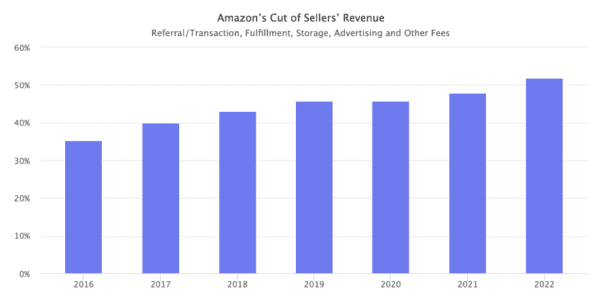

This increased competition comes as the cost of doing business on Amazon has spiraled, and not just because advertising has gotten more expensive across the board. Amazon’s average cut of each sale surpassed 50% in 2022, according to a study by Marketplace Pulse, which also found that sellers have been paying Amazon more per transaction every year for the past six years. These costs include not just advertising (a crucial expenditure to stand out on Amazon’s crowded “shelves”) but also sales commissions and fulfillment services including warehousing, packing and delivery (which, while optional, are used by 86% of third-party sellers).

Sellers’ relationship with Amazon feels akin to the love-hate dynamic between gamblers and their favorite casino. Like gamblers, sellers spend an inordinate amount of time studying the game and finding minute ways to eke out an advantage. And while for many of them the result has been remarkable success, in the end the House always wins too.

Without a doubt Amazon has been central to shaping ecommerce as we know it today. Now, the rise of platforms looking to compete with Amazon looks set to shape ecommerce’s next evolution by:

- Allowing brands to build out a broader omnichannel strategy that features a mix of digital platforms, with Ebay, Shopify and Walmart currently leading the pack;

- Putting the power back in the hands of brands as the cost of doing business on Amazon increases; and

- Developing integrations between brands’ DTC operations and their marketplace presence that could reshape consumer expectations.

Giving Amazon a Run for its Money

Amazon’s biggest competitor at the moment is Walmart, which launched its third-party marketplace in 2009 but didn’t really start hitting the gas until a few years ago.

“If you came on a while ago and gave up or hit a dead end, I would strongly encourage you to give us another chance,” Walmart Marketplace’s Jonathan Greer, General Manager for Hardlines and Seller Experience, told sellers during a session at Prosper. “We’ve made a lot of improvements on the platform. I think you’re going to feel like you’re getting a very different experience.”

It’s clear that Walmart’s marketplace is picking up real momentum; in fact, the vast majority of sellers at Prosper indicated that they are already selling on Walmart’s marketplace as well as on Amazon.

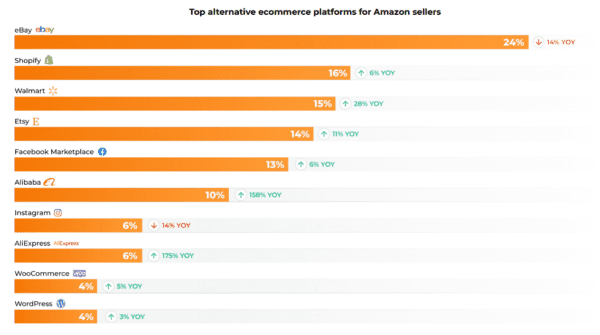

And Walmart isn’t the only marketplace gaining ground: Jungle Scout’s 2023 State of the Amazon Seller report revealed that 61% of Amazon sellers said they already sell on at least one other ecommerce platform, with Ebay, Shopify and Walmart as the top three. More than half (52%) of sellers said they plan expand to additional platforms in 2023, up from 30% in 2022.

Ebay, however, may be coasting on its long tenure. The marketplace has been around for as long as Amazon — they both launched in 1995, making them the two oldest (and still the two largest) online marketplaces in the U.S. But while Amazon has morphed almost beyond recognition in the 28 intervening years — moving well beyond the category where it started (books), adding fulfillment services and getting heavily into advertising among many other things — Ebay’s business model has remained largely static.

Jungle Scout’s survey found that Ebay was still the No. 1 “alternative marketplace” for Amazon sellers, with 24% of respondents indicating they also sell on that site, but that number is down 14% from a year ago. In contrast, the number of sellers now also selling on Walmart is up 28% year-over-year, Etsy is up 11% YoY and Alibaba is up a whopping 158% YoY. The picture becomes even clearer when looking at the marketplaces that sellers are considering adding to their roster in 2023: interest in Ebay as a potential for expansion is down 49% YoY, while Etsy is up 114% YoY and interest in Walmart is up 7% from 2022, according to numbers shared by Jungle Scout’s CMO Michael Scheschuk at Prosper.

Walmart Follows the Amazon Playbook

Now Walmart is making a big push to drive home its advantage as the leading alternative to Amazon. It’s certainly got the most Amazon-like offering, with fulfillment services, robust advertising options and a new membership program — not to mention a major marketing push to bring in sellers that included exhibiting at Prosper for the first time.

“The marketplace and the ecosystem that we’re building with advertising and WFS (Walmart Fulfillment Services] is actually a very critical component of how Walmart is thinking about growth in the future,” said Greer. “We think about our marketplace as an extension of our overall strategy and purpose, which is to help consumers save money and live better. We have 4,600 stores; we are within 10 miles of 90% of the U.S. population; we have 120 million shoppers that come into our stores or shop our website [every month], so as your next platform to join, or the next platform to invest in, I would say there’s no other place to look at than Walmart.”

Walmart makes a compelling case, but the fact is that its marketplace is “still messy,” as one seller described it to Retail TouchPoints at Prosper. Still, most of the advanced sellers at the event seem to think getting in now is worth it both for the marketplace’s future potential and as a way to reduce their reliance on Amazon.

While it didn’t show up in Jungle Scout’s survey, sellers also are very intrigued by Target’s marketplace. It’s not logging the kind of growth numbers as other marketplaces, largely because it’s so tightly controlled. Brands must be approved before they can sell on the platform (Retail TouchPoints met more than a few sellers at Prosper that were actually turned away), and once sellers are selected they must work with a third-party “integrator” to build out their listings.

While this more stringent curation process may be slowing the Target marketplace’s growth, it seems to be creating a more curated, cleaner experience that both sellers, and likely customers, appreciate. One seller that had been approved to sell on Target’s marketplace told Retail TouchPoints that it was “a gold mine” because sales on that platform were all incremental to his Amazon business.

Greer said Walmart is aware of the kinks in its marketplace and is working to address them. And to be fair, it took Amazon 20 years to build out the model that Walmart is now emulating.

That emulation goes all the way to driving home Walmart’s own focus on “customer obsession” (as it’s known at Amazon). “We are building this marketplace slowly and very intentionally, because we want the seller experience to be best in class,” said Greer. “There’s a famous quote at Walmart from our founder, Sam Walton: ‘We all have one boss, the customer. Our customer can choose to fire us any day, from the Chairman all the way down, by choosing to spend their money elsewhere.’ That’s how we’re trying to recruit sellers too — we need to earn your trust and your business. We know a lot of you spend a lot of time on another platform in Seattle, and have had an incredible amount of success there, so we’re really conscious of where we are in the market, our positioning and how we have to earn your trust.”

Perhaps the only place where Walmart is diverging from the Amazon playbook is by undercutting Amazon on prices across all fronts (sales commissions, fulfillment service fees, etc.), but whether this is a temporary tactic to lure sellers or a permanent extension of Walmart’s famed value proposition, only time will tell.

Combatting the Lure of DTC

But it’s not just other marketplaces that are giving Amazon a run for its money, as evidenced by the prominence of ecommerce platforms like Shopify and WooCommerce at the event and in discussions with sellers.

Brands now have access to a wealth of easy-to-use tools to launch their own ecommerce operations from these and other solution providers, and many of the sellers at Prosper are doing just that. Case in point, the opening keynote at Prosper was given by Cody Griffin, Senior Director of Marketing at men’s personal care brand Dr. Squatch, which Griffin said considers itself a DTC brand first and an Amazon seller second.

Amazon is well aware of the draw of DTC, especially for its best-selling third-party brands. Rather than fight it, the platform is leaning in with offerings like multi-channel fulfillment (which lets sellers use Amazon’s fulfillment services for orders from non-Amazon channels like a Shopify site) and Buy with Prime, which lets sellers offer the benefits of Prime membership to shoppers on their DTC sites.

Indeed, despite the rapid growth of some of these alternative marketplaces, the fact remains that Amazon has a huge head start and runs a well-oiled machine. More than 48% of consumers shop on Amazon at least once a week, according to Jungle Scout, and customers buy 7,400 products every minute from its U.S. sellers. Those are tough numbers to beat.