The digitization of brick-and-mortar stores is nothing new, but up until recently it has primarily been focused on surfaces in the store that are already digital: point-of-sale systems or back-of-house tasks like inventory management. As a result, as the science of commerce has evolved rapidly online, driving deeper personalization and more efficient deployment of marketing and logistics resources, the physical store environment has remained stubbornly analog.

There are exceptions of course, and there are certain retailers that are ahead of the curve when it comes to applying digital tactics in stores, but for the most part the best retailers have been able to do is use their websites, apps and social feeds as listening tools to understand what their consumers want. However, that looks set to rapidly change as technologies that turn every part of the store into a digital surface, one that can be quantified, analyzed and acted upon, move into the mainstream.

This tech was on display everywhere you looked at the NRF Big Show in January 2024, including:

- Computer vision solutions that allow stores to anonymously track and respond to consumers’ movement patterns and behaviors within stores, both in the moment and with larger strategy shifts like floorplan redesigns;

- Electronic shelf labels and shelf-monitoring solutions that enable real-time stock alerts and dynamic pricing, akin to that of large online marketplaces;

- The harnessing of store sales data, sometimes combined with ecommerce data and localized to specific regions, to drive merchandising and even marketing decisions;

- The integration of interactive screens in stores that serve up dynamic content from social platforms, localized information like the weather forecast and even personalized promotional offers; and

- Composable, or modular, store setups, not unlike the wave of “composable” website solutions that have swept ecommerce, enabling flexible floorplans that can be easily adjusted in response to all this digital intelligence.

To be clear, we’re not talking about next-gen store tech like autonomous checkout or inventory-light, QR-based store experiences like the now defunct Amazon Style stores and recent Pinterest pop-ups. These are interesting attempts to remove friction in store environments and bridge the physical-digital divide, but they are as yet unproven at scale — although they are likely to have a place further in the future.

What we’re talking about is how retailers today are using practices developed in ecommerce environments to turn their stores into data-rich sources of information, and then act on that intelligence. David Sherwood the CEO of Daniel’s Jewelers, described it perfectly in a recent LinkedIn post about his company’s efforts in this direction: “The retail shopping experience should be as scientific as the ecom experience,” he said.

If the NRF show is any indicator, then that is exactly things are headed in the coming years. Here are three examples of retailers already doing it today.

Rema 1000 x Revionics

Norwegian discount grocer Rema 1000 faces intense competition to keep its prices low. “You’re probably thinking: Norway? Almost no population, freezing cold, how can they have competition? But we do,” said Partap Sandhu, Head of Pricing at Rema 1000 during a session at NRF.

Adding to the fierceness of this competition is the regular practice of Norwegian newspapers: printing the prices of certain staple products at different retailers and announcing a price “winner.” These price comparisons happen regularly, but not on a set schedule, so retailers can’t build them into a pricing or promotion calendar.

Since low prices are Rema 1000’s core value prop, making sure it wins with connected consumers who can easily compare prices online every day (not only during the newspaper price roundups) is critical. So the retailer has implemented electronic shelf labels (ESLs) across all 675 of its stores and connected those ESLs to the Revionics pricing solution. Now Rema 1000 can make the decision to change a product price and roll it out across all of its stores in under 15 minutes, if needed.

That’s an impressive turnaround time, but perhaps even more impressive is how Rema 1000 stays on top of its competitors’ prices. Every day across the country, Rema 1000 employs a fleet of price checkers that together collect 1 million “price observations” every week, approximately 150,000 each day. Those “price observations” are loaded into the Revionics system, compared with Rema 1000’s assortment and current price and then, if called for, a price adjustment will be made and sent out to stores. Sandhu said that the company makes approximately 100 price adjustments every day.

This kind of dynamic pricing was previously only possible online and is in fact regularly practiced by a host of ecommerce retailers and marketplaces (Amazon being the poster child for this in the U.S.). For in-store shoppers, the practice of quickly pulling up your phone to check if a price is better somewhere else is now routine, but previously brick-and-mortar stores had no way to quickly make price adjustments to compete. Now, as Rema 1000 illustrates, they do, although presumably most retailers won’t need to do so on the same scale.

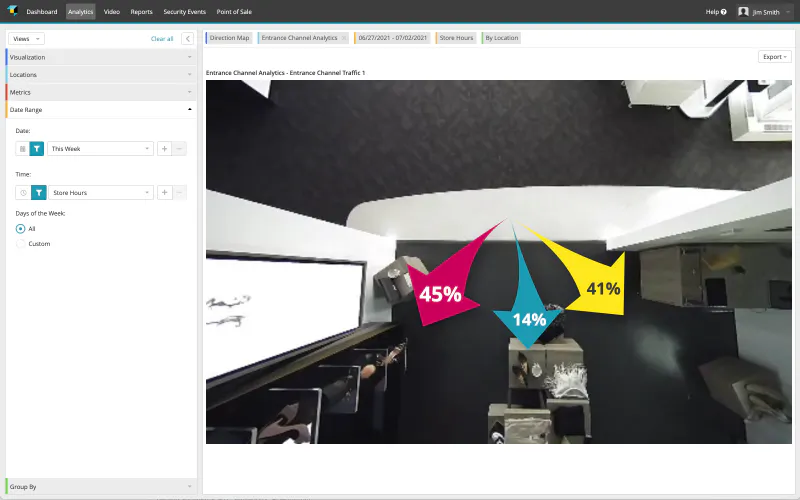

PVH x RetailNext and MarketDial

PVH Corp., parent company of the Tommy Hilfiger and Calvin Klein brands, operates more than 6,000 stores in 40 countries. In North America that operation is led in part by Mike Brown, PVH’s VP of Store Operations and Finance, who describes his job as “blending store tech with operational efficiency.” The perfect example of that has been PVH’s partnership with foot traffic analytics solution RetailNext and store measurement and testing solution MarketDial.

While PVH initially engaged the two solutions for separate purposes, Brown said “we quickly realized that there was this congruence, a kind of symbiotic relationship where we can use both to give us a 360-degree view of the customer and what was happening in our stores.” Brown gave a number of examples of this knowledge partnership at PVH brands’ stores across the U.S. in a session at NRF.

One example involved the “focus table,” a fixture of retail stores everyone — that table or area right up front that highlights a product or products that the retailer wants to promote: “We were testing different things and having mixed results, so we used RetailNext to fill in that data and get down to the granular level to see what the customer behavior was,” recounted Brown. “One of the things that we learned was that in some of the stores, the store manager had thought, and it’s a logical assumption, that this product is important so I’m going to put it right in the customer’s face. But if you think about when you go into retail, you need a moment to sort of scan the horizon and orient yourself, so we found that a lot of customers were just completely missing that table.”

As a result, PVH moved the feature table farther back into the store. They also realized, in looking at the foot traffic patterns and MarketDial analysis, that the back of this table was just as important as the front, because many customers would skip past it initially and then come around from the backside. Where previously ample attention was given to the front display while the back was an afterthought, through the analysis Brown and his team made the back of the feature table an equal priority for store staff.

“This has really become a cyclical process for us,” said Brown. “So I start with MarketDial to create a test and measure the results, but maybe we don’t get the results that we wanted. In the past we might have said, ‘Well, it didn’t work,’ and just move on. But now we engage RetailNext to look at the data and find out what the customer is doing. Maybe we realize the signage wasn’t clear or the product display wasn’t full. Then we tweak that and retest it.”

Websites have been able to track the traffic patterns of their visitors, even those who don’t make a purchase, for years. Now computer vision and IoT solutions like RetailNext and MarketDial are allowing stores to get that same level of insight into their in-person visitors.

“There’s so much rich data that comes out of RetailNext about the customer, and what I love is it’s not just [about] the customer that transacts,” said Brown. “So much of the data we previously had around the customer was only the people who were purchasing through credit card data or loyalty programs. But there’s a large portion of customers who come in and for one reason or another choose not to transact. Now we can tap into that. It’s even become kind of an idea generator to say, ‘Oh, we’re seeing this interesting behavior in this area. What if we did this?’”

Chevron ExtraMile x Samsung

Three Chevron ExtraMile convenience stores have launched a pilot with Samsung Electronics America, whose screens serve as the “digital highway” that various other technology partners will plug into, Parrish Chapman, Senior Director of Enterprise Retail Sales at Samsung told Retail TouchPoints at NRF.

Through integrations with a range of other technology partners, the Chevron stores — located in San Diego, Millbrae, Calif., and Vancouver, Wash. — are implementing dynamic merchandising and foot traffic analytics as well as displaying real-time social media content, local weather information and even an AI-powered sommelier called Sam.

Through an integration with FastSensor’s foot traffic analytics software, the three locations will gather ecommerce-style metrics about how customers move throughout the store in order to analyze traffic patterns, purchase intent, sales conversions and store sections with the highest traffic. Parent company Chevron Stations Inc. (CSI) said it will then use those insights to understand customer behaviors and preferences and improve the store experience.

Throughout the store, Samsung 4K UHD Samsung Smart Signage Displays are also showcasing dynamic content from the Samsung MagicINFO Content Management Solution, through integrations with Sprinklr Social for social media content and interactive polls and IBMWeather for weather forecasts and real-time offers tied to the local weather conditions. This kind of dynamic, interactive content underlines the excitement in the retail media landscape around expanding advertisers’ reach beyond the website and into stores.

And while decidedly falling into the “next gen” category, these ExtraMile stores also will feature an innovative new generative AI experience dubbed “Sam the Sommelier,” a hyper-realistic virtual assistant ready to help shoppers in the wine section. Customers can engage in a spoken conversation with Sam to find just the right wine for any occasion. As Chapman pointed out, the very focused nature of this gen AI experiment makes it easier to implement well and be more accessible to customers, who might be nonplussed about being greeted at the entrance by a fake human on a screen — but likely will be more than happy to have some help in choosing from the wall of wine in front of them.