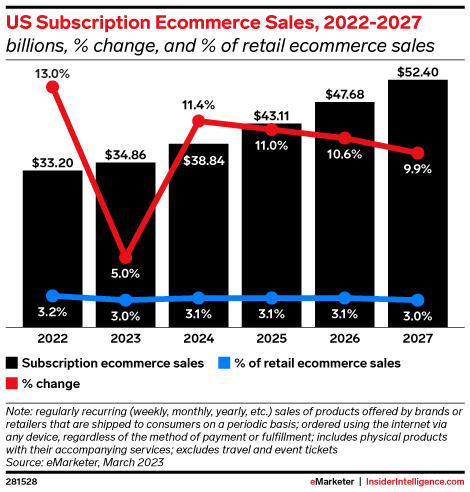

The subscription economy has been the subject of dire headlines recently, with terms like “subscription fatigue,” “the great unsubscribe” and even “subscription apocalypse” being bandied about. Some stats support the gloomy outlook: according to Kearney, 40% of consumers feel they have too many subscriptions, and subscription ecommerce is predicted to have its slowest growth year on record in 2023 (Insider Intelligence).

The reality though is less stark. Yes, the gangbusters growth subscriptions experienced during the pandemic is widely expected to slow, but overall the industry is still growing and subscription offerings are proliferating. The Subscription Trade Association’s (SUBTA) annual report found that nearly all (95.8%) U.S. consumers have at least one subscription, and predicts that the subscription market will reach a nearly $200 billion valuation this year and surpass the trillion-dollar mark by 2027.

And while more than half of consumers said they have canceled at least one streaming service since January 2023, among that group, 73.4% went on to subscribe to another (or the same) streaming service during that same timeframe.

“The biggest difference we’ve identified in 2023 is that the competition has now gone beyond companies’ respective verticals,” said Christopher George, CEO of SUBTA’s annual conference SubSummit, in the report. “Last year, we learned that for every subscription a customer adds, they cancel another, which has never happened before. Today, brands are competing for consumers’ share of wallet. This means that if you’re in the beauty industry, you’re competing with Netflix, for example.”

Jay Myers, Co-founder of headless checkout solution Bold Commerce, which powers close to 20,000 subscription brands, said that while this shift in consumer behavior indicates a subscription saturation point of sorts, it doesn’t mean the end of the model, just a recalibration. “Ten years ago if you had a subscription, you were winning; just simply [launching a] subscribe-and-save option was a competitive event,” Myers said at a session at SubSummit, which took place May 31 to June 2, 2023 in Dallas. “That’s not a competitive advantage today; subscriptions are table stakes.”

Given these trends, Myers said brands should turn their attention to the next big area of opportunity: paid memberships. He also identified three principles for getting the most out of those membership programs:

- Think of your offering as a “subscription value stack”;

- The value of the membership must always be increasing; and

- Leverage the powerful pull of sunk cost.

The Psychological Difference Between Subscriptions and Memberships

According to Myers, one of the biggest advantages memberships have over subscriptions is that they play into the innate purchasing behavior of “sunk cost,” which he described as when “a person is reluctant to abandon a course of action because they have invested in it, even when it’s clear that abandonment would be beneficial.”

“Brands leverage FOMO (fear of missing out); they leverage urgency; they leverage social [status],” Myers said. “There are all kinds of psychological reasons people make decisions, and brands are excellent at [using them], but very few are leveraging sunk cost. It’s a huge opportunity in that sense.”

The brands that are leveraging it, however, are seeing impressive results, with paying members buying more often, buying more and showing higher levels of brand affinity than members of free loyalty programs, according to Bold Commerce’s research.

A Moment of Opportunity

However, Myers is careful to point out that offering a free loyalty program isn’t enough to reap these rewards. The true opportunity lies in paid memberships.

The idea isn’t new. Costco pioneered the paid membership retail model more than 35 years ago, and Amazon’s iteration, its Prime membership, launched in 2005, further acclimatizing shoppers to the idea. Today, both Amazon and Costco have a significant portion of the U.S. population signed on, with 168 million U.S. members of Amazon Prime and 125 million Costco members, at the latest count. Other brands are following suit with their own paid memberships, including Best Buy, Walmart and DTC haircare brand Madison Reed, to name just a few.

And yet paid memberships are still not a mainstream offering from most brands, leaving a lot of white space. “Here’s what’s crazy — less than 5% of online stores have a paid membership program,” said Myers. “In five years, this [opportunity] won’t exist. The gap between the number of people willing to subscribe to a paid membership and the number of paid memberships available simply will never be [this large again].”

The rewards when a paid membership is done well can be significant. Myers pointed to Restoration Hardware, which has had a paid membership since 2016. Customers pay $175 a year for 25% off all purchases as well as access to member sales, interior designers and product exclusives. With 400,000 members, the deal certainly appeals to consumers, but it’s big benefit goes the retailer. According to Myers, while the actual membership fee is a nominal revenue driver, the members themselves are a goldmine — in 2022, 95% of Restoration Hardware’s revenue came from them. “[Restoration Hardware] actually doesn’t care about that $175, but they do care about the effect that it has on the buying behavior of the customer,” he noted.

That membership effect includes not only an inclination to shop with Restoration Hardware first and more often, but it also generates an increase in brand affinity that helps decrease customers’ price sensitivity. This latter effect can be seen with other memberships as well, such Amazon Prime and Starbucks. Once a customer is a member of these programs, they tend to do less shopping around because they feel committed to these brands. For example, Starbucks members who have pre-loaded money into the Starbucks app are not only less likely to go somewhere else for coffee, but Myers said they spend significantly more compared to customers who pay by credit card because that price sensitivity is lessened.

3 Tips to Doing a Paid Membership Right

While it might have a similar aim (recurring revenue, loyalty, deepening engagement), building a paid membership is very different from creating a subscription offering. Myers offered a number of tips for how to create a successful membership program, informed by insights from the top 100 brands using Bold Commerce’s software.

1. Think of your offering as a ‘subscription value stack’

While brands tend to bucket their subscription offerings into one of three categories — replenishment, curation or access — Myers said a paid membership must offer all three.

“Every single person gets subscription fatigue,” Myers said. “Even if they love your product, they’ll go away on vacation for a couple months or [they’ll get to a point where] they’ve got too much on the shelf. No matter what, they will get tired of your product, so if it’s only about your product, you’re pretty much done. What they need is that whole value stack, so if you sell a coffee subscription, do they get access to better prices, products before other people, do they get content? Maybe once a quarter there’s a Zoom call with the head roaster. [Maybe they] get discounts at yoga centers or gyms. If I have all this other value that I’m getting and I have a couple extra bags of coffee, I’m not going to break away because then I lose everything else.”

Verizon is creating this value stack with its new +play option, which lets Verizon phone, internet and/or cable customers buy and manage their subscriptions in one place (within the Verizon ecosystem, of course). Available subscriptions that can be added and managed with +play include streaming content like Netflix, Starz and the NBA app, as well as others like Qello Concerts and Blue Apron Plus. Not only does this position Verizon as a potential solution to the problem of subscription overload, but customers will almost certainly be less likely to jump on a promotion from AT&T if it means switching over not just their telecom services but their meal kit subscription as well.

2. The value of the membership must always be increasing

Verizon’s new +play offering also highlights Myers’ second piece of advice, which is that memberships should constantly evolve, because “what brought your customer in isn’t what’s going to keep them,” he said.

The prime example of this is of course Amazon Prime, which started with two-day free shipping and has now expanded to include an ever-growing slate of benefits, from live sports and entertainment offerings to one-click returns.

Myers pointed out that these new benefits don’t necessarily have to come at a cost. If you’ve built up a large membership of attractive consumers, they can be negotiated as partner benefits, wherein a brand offers your members a discount for the chance to access this subscriber base. The bottom line is that brands should aim for a 3:1 ratio between “perceived value” and amount paid. That is, customers should feel as if they get benefits worth 3X what they are paying in return for their membership fee.

That means brands absolutely have to make sure customers are aware of everything they are getting as part of their membership. “‘Perceived’ is the key word here, because if they don’t understand the value, then it’s worthless,” Myers said.

3. Leverage the psychological power of sunk cost

“We’re all suckers for sunk costs, everybody is affected by it,” said Myers. “As soon as you invest time or money or energy into something, you feel like you have to go through with it because you paid for it.” Examples Myers cited include finishing a bad movie because you paid for the ticket, staying in a bad relationship because of the time and energy you’ve already invested, keeping clothes you don’t wear and overeating at expensive restaurants.

Successful membership programs play into this phenomenon by reminding users of what they are getting — and potentially what they would be missing if they went somewhere else. Myers pointed to Spotify as a prime example. Because of the time subscribers spend building their playlists, and the time the algorithm spends getting to know its subscribers, the longer someone is subscribed to Spotify the harder it is for that person to leave.

As another example, Myers touted the benefits of making the small shift from offering members discounts to offering credit. He mentioned a clothing membership brand that wasn’t seeing any sales traction from its member discount. Instead, Myers suggested they offer a shopping credit. “Which are you more likely to use?” said Myers. “If [it’s the end of the month] and I haven’t used my $100 credit, I’m going to go online and use it, because if I don’t, I lose it. Versus when I don’t get my discounts, I just don’t get a discount — it has a very different effect on the buying behavior.”

And in the end that is what much of this is about, reshaping these recurring revenue models to take into account the innate psychology of human shopping and catering to it.