At Apple’s 2022 Worldwide Developers Conference (WWDC), the tech giant unveiled a slew of updates for its impending iOS 16 release, including a new buy now, pay later (BNPL) option that will be incorporated into Apple Wallet.

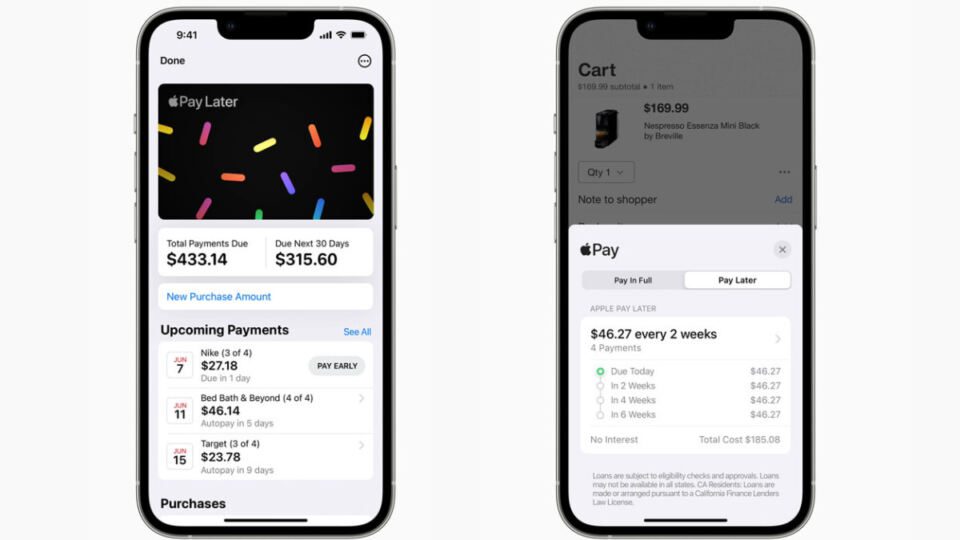

The service, called Apple Pay Later, will let users split any Apple Pay purchase into four equal payments, spread over six weeks, with zero interest and no fees. The service will be available everywhere Apple Pay is accepted online or via the Wallet app using the Mastercard network, and shoppers will be able to view, track and repay Apple Pay Later payments directly within their Apple Wallet. At launch, Apple Pay Later will only be available in the U.S.

Apple’s new offering promises to heat up competition in the already crowded BNPL space. Valued at $5 billion in 2021, the global BNPL market is projected to be worth upwards of $39 billion by 2030, according to Grand View Research. However, an increase in missed payments and skyrocketing interest rates are putting a damper on consumer and investor enthusiasm. A number of BNPL pioneers, including Klarna and Affirm, have seen their valuations take a nosedive with recent shifts in the economic winds.