Buy now, pay later (BNPL) was the trendiest way to pay for all those lockdown purchases back in 2020. But now, as BNPL offerings — and consumers’ understanding of them — mature, the explosive growth of the last two years is slowing. With inflation and interest rates on the rise, a more nuanced approach to BNPL is emerging, and experts say that’s a good thing for both consumers and retailers.

Also known as pay-over-time or pay-in-4 installment plans, BNPL offers consumers the chance to split up the cost of major purchases directly at the point of sale. Most buy now, pay later offers are interest- and fee-free, unless customers miss a payment.

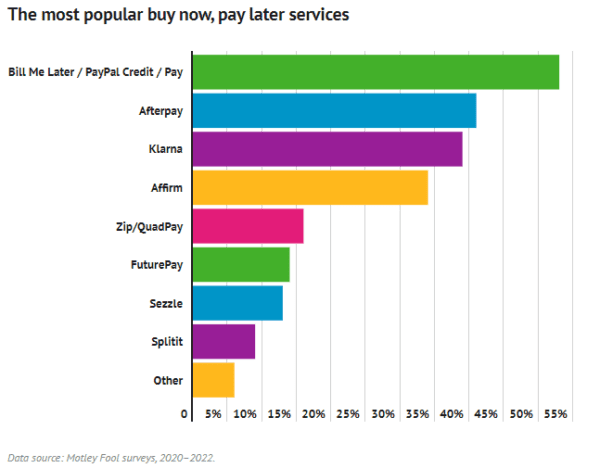

Despite slowing in pace, consumer uptake of BNPL is still robust, with Klarna, Afterpay and Affirm all reporting increases in active consumers earlier this year. In fact, 50% of U.S consumers say they have used a buy now, pay later service, according to a recent study from The Ascent, a Motley Fool service.

The entrance of Apple into the BNPL arena was seen as a vote of confidence for these offerings, and Apple isn’t the only one getting in on the action. BNPL provider partnerships with ecommerce platforms like Shopify, WooCommerce and BigCommerce (all with Affirm), have exposed an even larger swath of consumers to BNPL, not to mention the ever-growing roster of retailers signing on with those same providers.

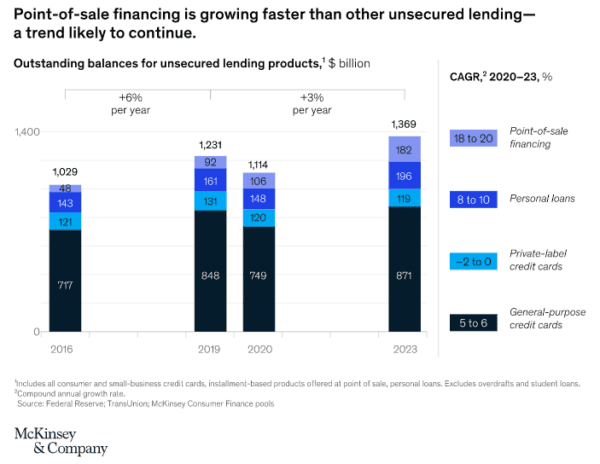

Legacy financial institutions don’t want to be left behind either, especially with buy now, pay later cutting into credit card usage. Mastercard, for example, continues to expand its BNPL offering with merchants such as Walgreens and Saks Fifth Avenue. But it’s another familiar name, PayPal, that currently dominates the BNPL space — more than half (53%) of U.S consumers have used PayPal’s BNPL options at some point, far outpacing other providers, according to The Ascent.

There are headwinds on the horizon though: The Ascent’s study shows usage levels plateauing, particularly among older consumers. Pressure also is increasing on BNPL providers from both the regulatory and financial sides of the business. Even so, BNPL is expected to be the fastest-growing payment method, both online and in stores, through 2025, according to the FIS annual Global Payments Report. By 2025, buy now, pay later is projected to account for 1.6% ($941 billion) of global POS transaction value.

The question now is what form this growth will take, and how BNPL will evolve in the coming years.

- Examining the similarities (and differences) between BNPL and layaway offers insight into why BNPL has risen so quickly in popularity;

- A look at the crosscurrents currently impacting the BNPL industry — shifting consumer habits, inflation and rising household debt — offers clues to what might lay ahead for the industry; and

- As with any new offering, white spaces still exist for BNPL to continue to expand its reach despite an economic downturn, including expansion into stores, retailer-branded offerings and as a potential vehicle to build credit history.

The Appeal of BNPL: Layaway Without the Stigma

The rise of BNPL is in many ways a case of the right product at the right time. “BNPL isn’t really an innovative product; it’s kind of the old layaway, catalog finance product, but there was a route to market innovation that came together with a consumer trend,” explained Jonathan Sharp, Managing Director at the Consumer and Retail Group at Alvarez & Marsal (A&M) in an interview with Retail TouchPoints. “It was a super easy, one-click [offering] at the point of transaction at exactly the moment that ecommerce was skyrocketing during the pandemic. Put those two things together and you’ve created a really easy way for the consumer to access deferred payment at a moment when they were spending like drunkards online.

“I think the single biggest difference [from layaway] is BNPL is anonymous,” Sharp added. “You don’t have anyone looking at you with that face that says, ‘Oh, you can’t afford to buy this outright?’ The other thing we shouldn’t forget is that social attitudes toward credit have transformed since layaway was around. BNPL feels like a decision I have chosen to take, rather than a decision I’ve been forced to take.”

The dynamics for retailers are also different than they are with layaway. With BNPL, the consumer gets the product immediately and the retailer gets paid immediately. Any financial risk associated with the loan is typically assumed by the BNPL provider. Retailers pay a percentage of the transaction price to the BNPL provider (anywhere from 1.5% to 7%), but most agree that these fees are well worth it, since the retailer takes no lending risk and because the availability of BNPL has been proven to increase basket size. A 2021 survey from The Strawhecker Group found that 55% of surveyed BNPL users spend more than they would with other payment methods.

“BNPL fulfills a need that previously wasn’t being met,” said Sharp. “Consumers regard it as a very transparent, manageable credit product. They can create very low monthly payments, they know what those payments are and they access it without an impact on their credit rating. There is also a supply side thing going on where each of these [BNPL providers] are doing deals with retailers to drive their presence, but I don’t think supply side things sustain themselves if it doesn’t meet a consumer need.”

Economic ‘Crosscurrents’ Present Mixed Outlook

It can actually be easy to forget that BNPL is a credit product, which is both part of its appeal and also a danger, particularly as economic conditions worsen.

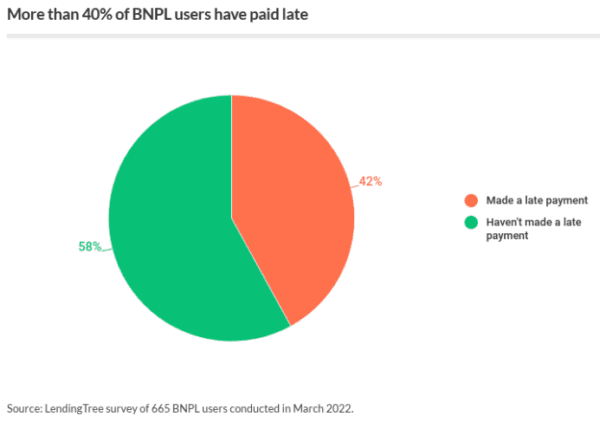

“More consumers have now been using BNPL for longer, and many consumers who are now in a payment cycle are also dealing with prices skyrocketing, so the squeeze on their budget is higher,” said Sharp. “We are likely going to experience more consumers going to a place with this product that they haven’t before, and participating in a way they weren’t expecting [e.g. with late payments, fees, etc.]. Then I can see a change coming. All financial services, particularly all credit product innovation, tends to go from being lightly regulated to being more regulated as consumers interact with it.”

Indeed, a March 2022 survey from LendingTree found that 42% of BNPL users in the U.S. have made a late payment, potentially signaling a shift in the BNPL realm, where “delinquency levels have typically been at or near historic lows.” This is particularly marked among Gen Z, the consumer set most likely to use BNPL, and also the group most likely to struggle to make large payments, according to The Ascent survey.

“Gen Z is the most likely to use buy now pay later services, but they’re also the most likely to have had a late payment in the past 12 months, the least likely to understand the terms and conditions and the least likely to think of BNPL as a form of debt compared to other age groups,” said Jack Caporal, Financial Research Analyst at The Motley Fool in an interview with Retail TouchPoints. “Those findings were maybe less surprising than they were eyebrow-raising — it might suggest that there’s potential for Gen Z to overextend themselves with buy now, pay later.”

For these same reasons, consumer watchdogs are turning their attention to BNPL, particularly with both consumer prices and household debt at record highs. The Consumer Financial Protection Bureau launched an inquiry into BNPL in December 2021, citing concerns about “accumulating debt, regulatory arbitrage and data harvesting in a consumer credit market already quickly changing with technology.” Similar actions are also taking place in the UK.

Whether more stringent regulation will follow is anyone’s guess, but Hemal Nagarsheth, Partner in the financial services practice of Kearney, said in an interview with Retail TouchPoints that he thinks “the fact that the CFPB is looking at BNPL might spur the private sector to [preemptively] address concerns.”

Whether an economic downturn will be good or bad for BNPL is also unclear. On the one hand, consumers tend to turn to credit products in tight times, but as Caporal pointed out, consumer spending is also shifting away from goods altogether and toward services, an area where BNPL offerings are less common.

Adding to the strain is the financial pressure that rising interest rates are putting on BNPL providers’ own lending. As the cost of their own debt rises, BNPL providers are more vulnerable to customer defaults at a time when they are more likely. This is part of the reason behind industry darling Klarna’s huge drop in valuation earlier this year, from $45.6 billion in 2021 to $6.7 billion in July 2022.

“There are some crosscurrents,” said Sharp. “If providers can manage any kind of reputational blowback from existing customers interacting with BNPL in a way they weren’t expecting [such as being charged late fees], then the economic environment we’re going into presents favorability for BNPL. With household budgets being squeezed, consumers are going to have to economize on indulgences and gifting. One way to get into those categories that you might otherwise have to trade out of is buy now, pay later. This actually creates an opportunity to expand BNPL amongst consumer types that previously weren’t participating.”

White Spaces Still Exist for BNPL

Consumer spending shifts toward services presents another area of opportunity for BNPL, according to Sharp. His firm looked into categories with the lowest BNPL penetration, which include dining, grocery, gas, pet supplies, airline and travel.

“The interesting thing about at least two of those — dining and airline and travel — is that they are indulgences that otherwise would get squeezed out in more difficult economic times,” said Sharp. “When we asked consumers if they would be prepared to use BNPL in these categories, 40% said they would consider it for airline and travel. So I think there are untapped white space categories where the consumer is giving quite a lot of permission for this product, and those categories also happen to be in the parts of household spending where consumers know they’re going to otherwise have to cut back to pay their gas and food bills.”

Here are a few other white space areas for BNPL:

1. In-store POS: The recent explosion in BNPL primarily happened online, because it was easy to plug the required tech into ecommerce sites, but given robust consumer demand, both Nagarsheth and Sharp think it’s only a matter of time before BNPL becomes commonplace at brick-and-mortar POS as well.

The only sticking point is the tech. As Nagarsheth points out, it can be costly for retailers to upgrade their POS systems to enable new payment methods, which is why Sharp believes in-store demand for BNPL will also drive the penetration of digital payment solutions at physical retail locations. “You can definitely envisage a situation in which you pay with Apple Pay or Google Pay in a store, and then you get a message from Apple about whether you want to put it on the monthly statement or make a deferred series of payments with it,” said Sharp.

In-store BNPL offerings are already starting to make an appearance. HBX, the ecommerce platform of men’s streetwear brand Hypebeast, recently signed on with Afterpay to offer BNPL online, but said the offering would also be making an appearance at its NYC flagship soon. And Klarna has teamed up with payments provider Blackhawk Network to bring its BNPL solution to physical stores across the U.S.

2. White label BNPL: While most retailers thus far have tacked on a solution from a fintech provider to offer deferred payment plans to their customers, new white label options are on the rise, and they offer all the benefits of a branded credit card.

“A lot of this is actually driven by banks that have white label solutions,” explained Nagarsheth. “Even though BNPL awareness has grown, in many cases consumers may not recognize those names, but they will likely recognize the name of a bank [and certainly that of a retailer]. Better recognition leads to better trust, [and that] might tip the scales in terms of the customer taking advantage of BNPL.”

Bed Bath & Beyond has become one of the first to do this with its new Welcome Pay deferred payment program, part of the retailer’s recently revamped Welcome Rewards membership program.

3. Loyalty Integration: BNPL providers have already entered the loyalty landscape with their own rewards program (see: Klarna Rewards Club and Afterpay’s Pulse Rewards), but now they are working with their retail partners to drive that loyalty even further. For example, a member of Nordstrom’s loyalty program who chooses Afterpay at checkout and enrolls in Pulse Rewards can earn points for both loyalty programs with a single purchase.

4. BNPL as an Access Point to Credit: At the moment, BNPL’s relationship with credit ratings is murky. For example, while BNPL loans aren’t tracked by the major credit bureaus, missed or late payments often do end up on credit reports. But if Experian, Equifax and the like can find a way to accept more robust BNPL payment data, which they are working on, it could provide a low-barrier entry point for consumers to build their history, something that would be particularly useful to those who don’t have access to other forms of credit. And doing so might encourage increased BNPL uptake from those same consumer groups.

The story of buy now, pay later and its impact on the worlds of both commerce and finance is only in its opening chapters, and there will almost certainly be more twists and turns ahead. If other lending products are any predictor, then stricter regulation is likely on the horizon, as is a less rosy opinion from consumers — but none of that has stopped credit cards from filling shoppers’ wallets. By all accounts BNPL is well on its way to becoming another commonplace tool in both consumers’ and retailers’ payment arsenals.