Segmentation and targeting are becoming more important to the overall web and cross-channel merchandising strategy of 98% of mid-sized retailers (98%), according to new research from ATG (Art Technology Group).

The company recently revealed the results of its research study titled “e-Commerce Technology Investment Priorities for the Mid-Market: The Merchant View,” which examined web growth priorities among mid-sized and fast-growing merchants in a variety of industries.

“For years we’ve encouraged retailers and other merchants to embrace segmentation and targeting, because these types of merchandising tactics enable them to create more personalized, compelling experiences for their customers,” said Bill Zujewski, VP Product Marketing, ATG. “Ultimately, this leads to more sales and higher loyalty, and it also makes those customers feel better about doing business with a company that seems to understand their needs and preferences.”

ATG polled e-commerce executives at mid-market companies to analyze their technology investment priorities. It also gathered data about current tools being used, as well as their plans to incorporate emerging sales channels, such as mobile and social commerce capabilities, into their overall web and cross-channel strategy.

Trend Toward Targeting

The report highlighted the growing pain felt by retailers still on their first-generation e-commerce site, which typically haven’t kept pace with retailers’ needs. The survey found that 80% of mid-sized merchants see e-commerce growth as very important or critical to their overall business in the next 1-3 years.

Yet, while it is clear that driving web revenue is a primary business objective for mid-sized companies, on average 40% of the merchants surveyed said they are not satisfied with their site’s current shopping experience, as it pertains to maximizing revenue potential. One-third of respondents said they plan to re-platform and re-launch their sites in the near future.

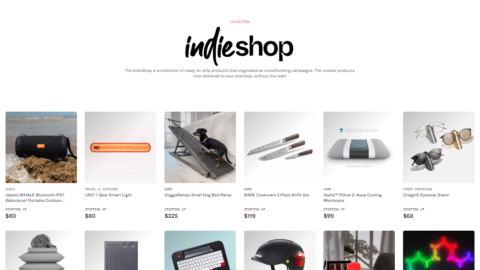

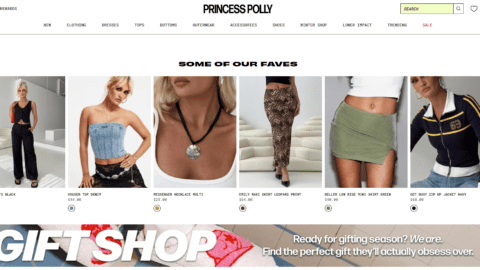

The data highlights a clear demand among mid-sized merchants for better business tools and underscores their need to merchandise to key segments using technologies and services that personalize everything from promotions, product recommendations, and search results, to customer service.

“Retailers should be looking at new ways to understand and connect with their shoppers, whether it’s on the web, in-store, via mobile device or through the call center,” Zujewski said. “And above all retailers need to be treating their customers consistently and intelligently based on the channel they’re using and their needs at any given moment. The commerce platforms that in the past only governed the web are now being used by many retailers as the underlying base for web, in-store, call center, mobile and social operations.”

Search & Social Top Enhancements

When merchants were asked which aspects of their web site’s shopping experience they would like to significantly improve in the next 6-24 months, more than half (52%) cited dissatisfaction with the business tools they use for merchandising and promotions.

Specifically 62% said they would like to improve their ability to offer, control and manage cross-sells and up-sells to encourage more sales, while 60% said they would like to improve their site search functionalities. To further enable targeting, 55% of respondents said they would like to improve their ability to offer, control and manage promotions.

With regard to customer experience optimization, the study found that more than half of retailers surveyed (53%) plan to improve by experimenting with emerging sales channels, such as mobile and social commerce, while 42% plan to improve by investing in add-on services, widgets and tools they can implement on their existing site.

“In additional to providing more detailed information, offering ratings and reviews is another way for retailers to improve the cross-channel experience,” Zujewski said. “Consumers value their peers opinion, so having a place for consumers to review and post product feedback can easily give third-party credibility. And, live help solutions, such as click to call and click to chat, can make communication easier on the customer and much more efficient for retailers, and provide a bridge between online and offline interactions.”

Click here to download the full report.