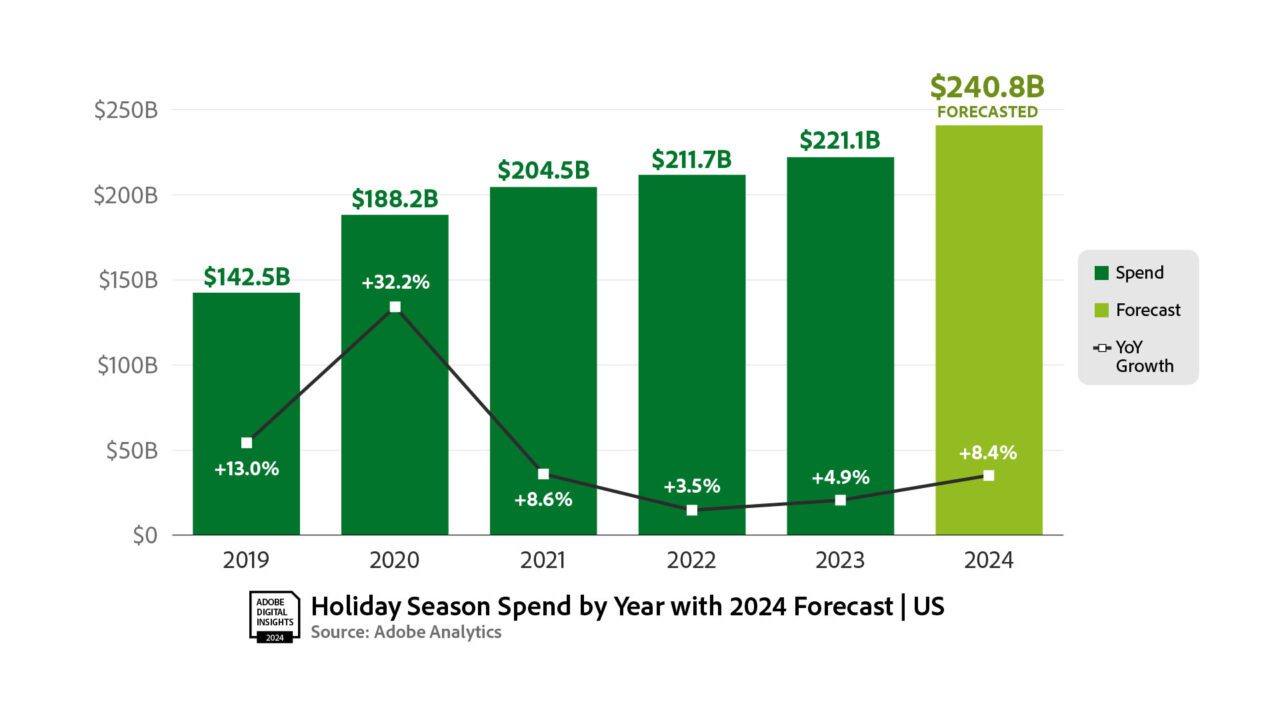

Adobe expects U.S. online sales to hit a record $240.8 billion this holiday shopping season (designated as the period from Nov. 1 to Dec. 31), representing 8.4% growth year-over-year. Shopping on mobile devices also is expected to hit a new milestone, growing 12.8% YoY to contribute a record $128.1 billion, which would represent a 53.2% share of online spend this season versus desktop shopping.

The forecast is based on Adobe Analytics data, which draws on more than 1 trillion online visits to U.S. retail sites, 100 million SKUs and 18 product categories. As Retail TouchPoints has reported, discounting is expected to drive both the timing and amount of holiday spend this year, as inflation-weary consumers time their purchasing to promotional periods. Following the same trend, usage of buy now, pay later (BNPL) financing solutions also are expected to reach record levels this holiday season.

Cyber Week will Still Reign Supreme

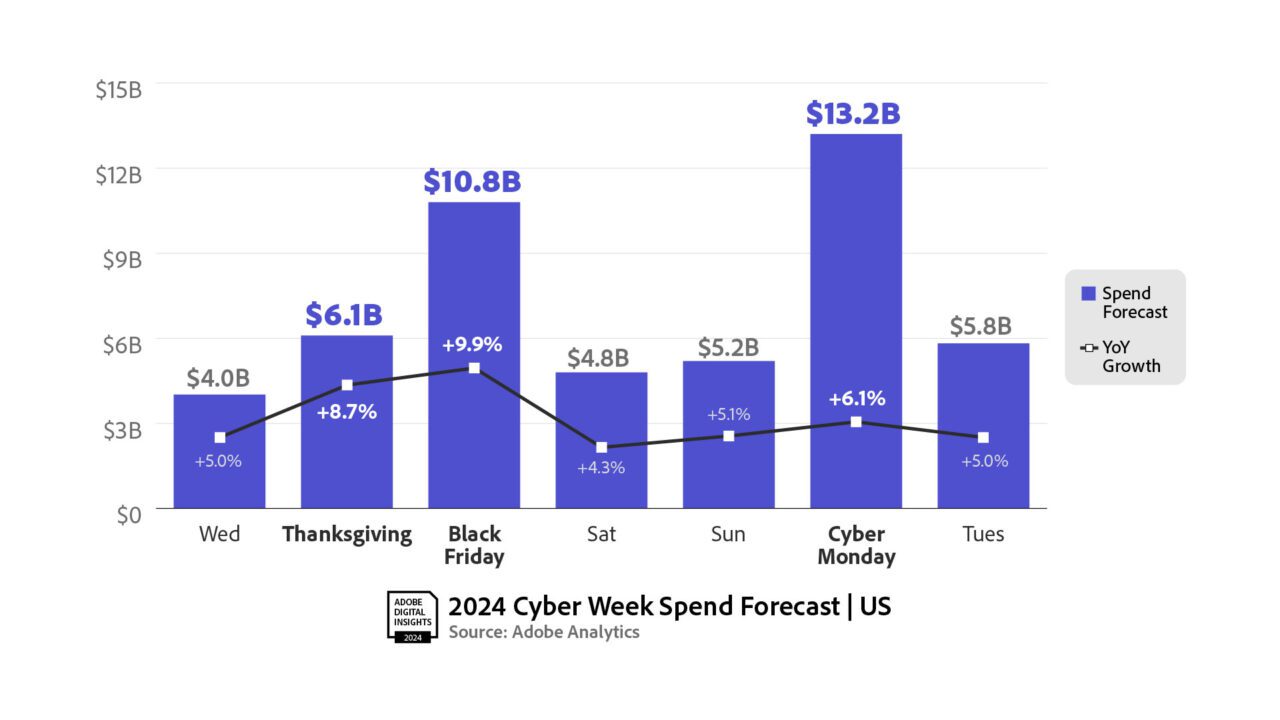

This season the deepest discounts are expected to hit during Cyber Week (the five-day period that begins Thanksgiving Day and includes Black Friday and Cyber Monday). Cyber Week is expected to drive $40.6 billion of the season’s total online spend, up 7% YoY and accounting for 16.9% of overall holiday season spending.

Cyber Monday is expected to remain the season’s, and the year’s, biggest single shopping day, driving a record $13.2 billion in spend, up 6.1% YoY. However, Black Friday ($10.8 billion, up 9.9% YoY) and Thanksgiving Day ($6.1 billion, up 8.7% YoY) are both expected to outpace Cyber Monday in year-over-year growth as consumers embrace earlier deals.

While deals are expected to peak during Cyber Week, Adobe noted that discounting will begin in mid-October, with Amazon’s Prime Day event expected to drive discounting across U.S. retail by up to 16% off the listed price. And even after Cyber Week, discounts of up to 15% off the listed price are expected to linger through the month of December.

Discounting will Continue to Drive Incremental Growth

These discounting windows are important because Adobe anticipates that this year’s price-sensitive consumers will be especially tuned in to promotional events.In fact, in previous holiday seasons, discounting has been a reliable driver of consumer demand and ecommerce growth for retailers, Adobe noted.

Adobe found that for every 1% decrease in price during promotional events such as Prime Day, President’s Day, Memorial Day and Labor Day, demand increased by 1.025% compared to the year prior, driving an incremental $305 million in online spend so far this year. For the upcoming holiday season, Adobe expects that discounts will contribute an incremental $2 to $3 billion in online spend, which is factored into the $240.8 billion forecast.

“The holiday shopping season has been reshaped in recent years, where consumers are making purchases earlier, driven by a stream of discounts that has allowed shoppers to manage their budgets in different ways,” said Vivek Pandya, Lead Analyst at Adobe Digital Insights in a statement. “These discounting patterns are driving material changes in shopping behavior, with certain consumers now trading up to goods that were previously higher-priced and propelling growth for U.S. retailers.”

Holiday Shoppers will Buck Year-Long Trend Toward Cheaper Goods

Prior to the holiday season, months of persistent inflation had led shoppers to embrace cheaper goods across most major ecommerce categories. However, this trend is expected to reverse during the holiday season, when, driven in large part by competitive discounts, the share of spending consumers direct toward more expensive goods is set to increase by 19% compared to pre-season trends. This effect is expected to be particularly strong in the sporting goods, electronics and appliance categories.

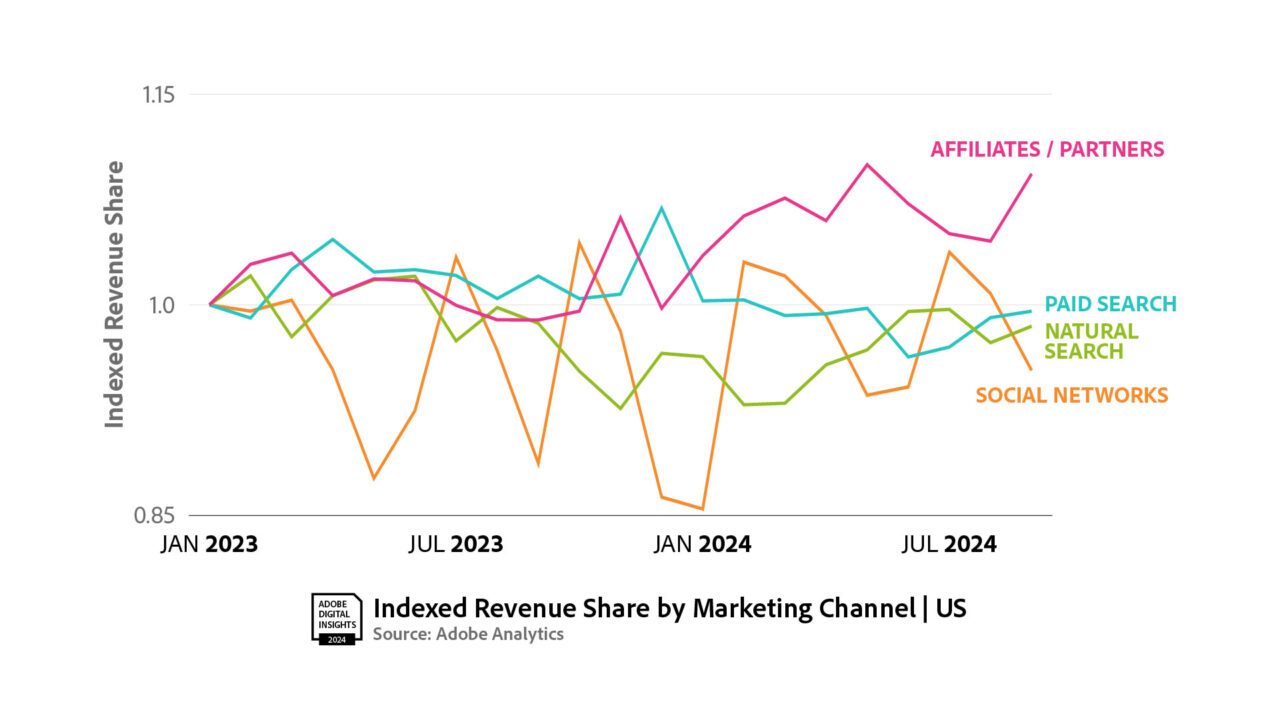

Paid Search Remains Top Driver, but Influencers will be Influential

Across major marketing channels, paid search has remained the top driver of retail sales (accounting for a 28% share of online revenue from Jan. 1 to Sept. 3, 2024) and is expected to grow by 1% to 3% during the holiday season. The fastest growth is forecast to come from affiliates and partners (17.2% share) which includes social media influencers, at 7% to 10%.

Throughout 2024, Adobe’s data showed that influencers are converting shoppers 10X more than general social media activity. This trend is expected to continue through the holiday season, with influencer-driven traffic expected to outpace retailer traffic from social media overall.

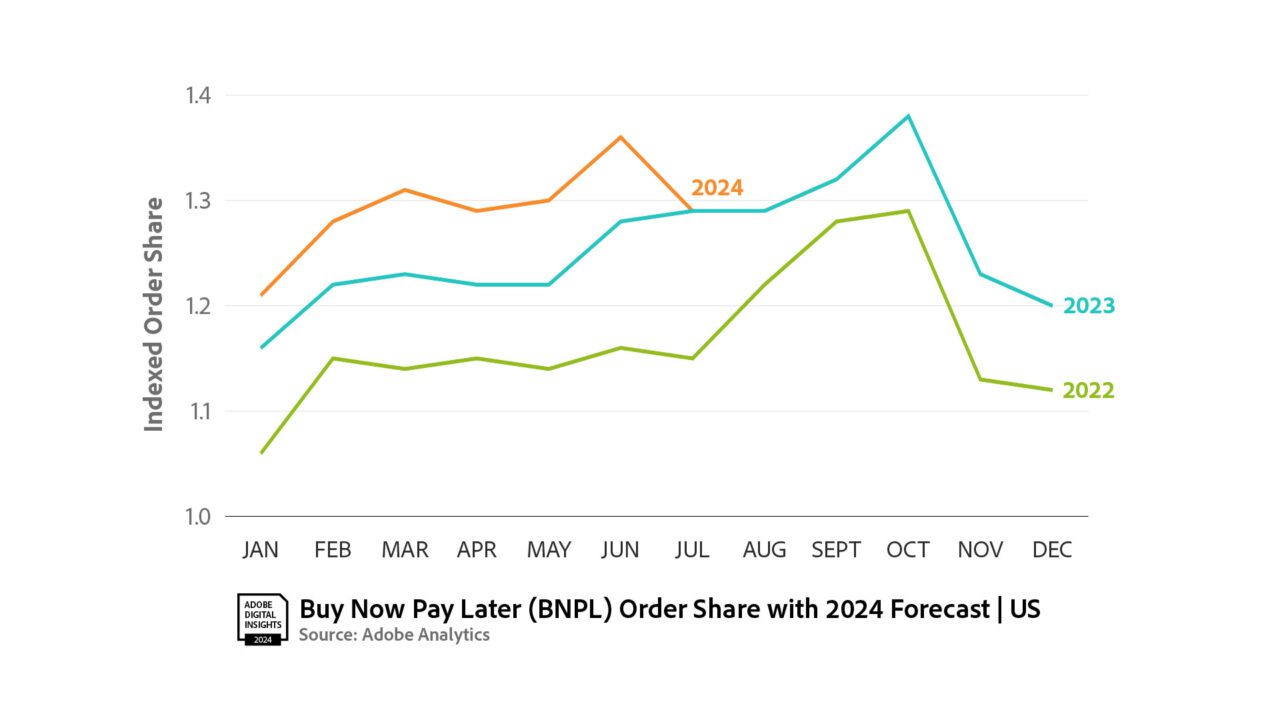

BNPL will Set New Records

BNPL is expected to set new records this season, driving $18.5 billion in online spend, up 11.4% YoY. Adobe expects BNPL to hit $9.5 billion during the month of November, making it the largest month on record, with Cyber Monday set to be BNPL’s largest day on record at $993 million.

BNPL is predominantly driven by increasingly popular mobile shopping, with its share of spend expected to hit a staggering 74% to 79% versus on desktop. In a recent survey Adobe found that 39% of millennials plan to use BNPL services this season, followed by 38% of Gen Z. The most common reasons cited for using BNPL include freeing up cash (per 22% of respondents) and the ability to purchase something they couldn’t afford otherwise (19%), which follows in line with the trend of consumers trading up in price point for their holiday gift-giving.