Retailers have reason to be positive about the holiday season — Americans are still planning to spend about the same or more than last year on gifts, despite the fact that 93% are concerned about the economy and rising living costs, according to EY’s latest Consumer Future Index. Some retailers will still feel pain, with 52% of shoppers spending less on non-essential consumer goods, but the holiday surge should still be a powerful force.

However, Americans’ optimism isn’t being shared globally: EY found that 89% of worldwide respondents say they plan to spend less or not increase their spending on their families this holiday season, and 41% will spend less on gifts for friends. Only 10% of global shoppers won’t change any spending habits because “traditions are traditions.”

However, shoppers in general are feeling optimistic, with 74% looking forward to getting “back to normal” after the disruption of the COVID-19 pandemic and 53% eager to catch up on missed experiences.

Monetary and Planetary Concerns Define Shoppers’ Demands

The poor economy is affecting what shoppers are looking for: approximately two-thirds (67%) of respondents say they are happy to repair their belongings rather than buy new, while 45% care more about the usefulness of the products they buy. This overall trend could have the biggest impact on fashion retailers, as 63% of respondents globally said they don’t feel the need to keep up with the latest fashion trends.

Interest in useful products will carry over to gift-giving trends. “Affordability first” respondents, representing approximately 25% of those polled, are very concerned about the rise of living costs (62%). Additionally, 59% of this group only plans to shop for essentials, which means their holiday spending will be on gifts they feel are useful rather than trendy items; for example, 60% of these respondents are planning to spend less on fashion and cosmetics.

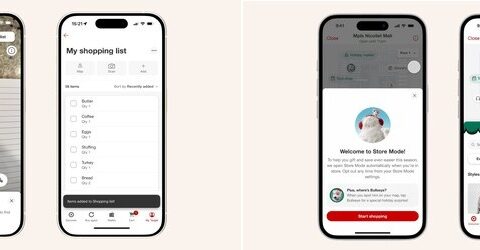

Shoppers’ concerns with affordability also will impact how they shop — 36% of Affordability first respondents (who accounted for 20% of all respondents) prefer to shop in-store during the holidays. This contrasts with “Experience first” respondents, who have widened their interest in experiences to more virtual spaces. More than one-third (36%) of this cohort will purchase virtual products such as metaverse skins, and 43% have purchased a product directly from social media.

Another major cohort is “planet first” shoppers, who represent another 25% of all respondents. These consumers have fewer financial worries and are less likely to cut their spending, except in cases where doing so dovetails with sustainability — 41% will buy fewer physical goods for environmental reasons. Additionally, 37% will look to buy locally made gifts.

“The holiday season may be a challenge for many as price increases due to inflation have swept the board, particularly in gas, household energy and fresh/packaged food,” said Kristina Rogers, EY Global Consumer Leader in a statement. “With more income now required just to cover the essentials, gifts will be more carefully considered and with an added lens of ‘usefulness,’ companies will need to guide their customers by providing a wide range of price points and information available on the environmental impact of their products.”