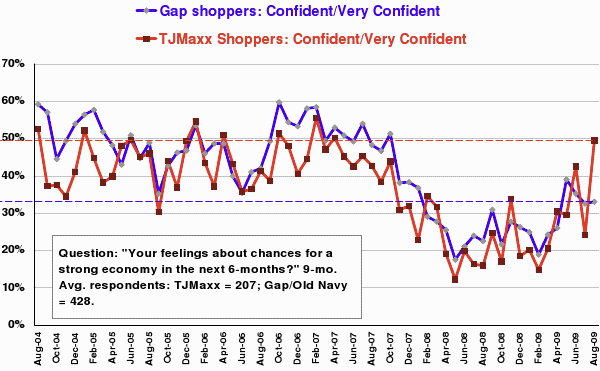

TJMaxx shoppers were more confident than Gap shoppers during the difficult economic times in late 2008, giving TJMaxx an edge in bringing in sales, according to ForecastIQ, a service of Prosper Technologies that is a forecast of same store sales based on consumer purchase intentions and behavior.

TJMaxx shoppers also proved to be more confident about the economy than Gap shoppers in 2009, resulting in positive comp store sales for TJX and negative numbers for Gap. In July of 2009 TJX comp store sales were 4.0% compared to -9.0% for Gap North America.

The ForecastIQ report is derived from BIGresearch’s monthly Consumer Intentions and Actions (CIA) Survey, combined with retailers’ same store sales data and consensus estimates. This information results in 45- and 75-day forecasts plus an enhancement to the consensus currently provided in the marketplace. The forecasts are customized for each retailer.

With this information in hand, retailers can more accurately adjust merchandising strategies and determine better store positioning to maximize sales potential.

For example, ForecastIQ determined that for March 2009 sales loss expectations were under-predicted for both Gap and BJ’s Wholesale Club. The prediction for Gap was a loss of 9.0% and for BJ’s a loss of 4.4%. ForecastIQ predicted losses of 11.36% for Gap and 6.56% for BJ’s, estimates that turned out to be much closer to the actual numbers recorded. Actual sales losses were 14.0% for Gap for 6.8% for BJ’s.

“ForecastIQ bridges analyst expectations and shopper behavior, helping to anticipate whether actual results will differ from analyst consensus,” says Richard Hastings, consumer strategist at Global Hunter Securities.

ForecastIQ was able to predict 45-day forecasts for Walmart Stores within 1.8 percentage points, for the period of March 2007 through April 2009.

Predications for market sectors

In addition to predicting sales for individual retailers, ForecastIQ can show patterns across multiple retailers, to help determine where consumers may be shifting their spending. “Surveys of shoppers from one retailer will tell us where they might be spending their limited discretionary dollars at other retailers,” notes Hastings.

In one study ForecastIQ found out that Gap shoppers may be spending some of their dollars at JCPenney. Over time from 2004-2008, Gap shoppers consistently report a favorable view of JCPenney womenswear and menswear.

In a recent study of the Warehouse Club sector, ForecastIQ accurately predicted the ups and downs in sales from 2004 through 2008. “All the clubs have taken a hit and our tools have kept up,” says Professor Greg Allenby, PhD, Fisher College of Business at The Ohio State University. Allenby helped create the ForecastIQ service.

In the Walmart versus Target arena, ForecastIQ has found out that Walmart shoppers go to Target for their health and beauty products. This information provides Walmart the opportunity to focus more attention on these categories to try to gain market share and drive new traffic to these categories.

Extra help in a down economy

Being able to more accurately predict sales becomes increasingly significant when overall sales are down. ForecastIQ can help retailers better determine strategies regarding pricing, market share, foot traffic, demographics, and overall shopping deferrals.