Employee satisfaction plays a central role in store operations. After all, when employees are happy and engaged, they create more productive and profitable store environments. But one survey found that nearly one in every two frontline employees are unhappy with their job due to low pay, inflexible hours, poor leadership and a lack of growth opportunities.

Retailers are tasked with tackling these challenges while navigating other issues disrupting their business, from rising theft rates to heightened customer demands for more seamless and transparent shopping experiences. As a result, the 74% of merchants that saw their store operations budgets increase between 2023 and 2024 had to figure out the best way to allocate this money toward a wide-ranging set of needs, from new in-store technology and inventory management solutions to employee training and engagement initiatives.

The results of Retail TouchPoints’ annual Store Operations Survey reaffirm the ongoing tug of war retailers are playing — between providing top-level service on one hand and boosting profitability by keeping costs down on the other. This contest is taking place as retailers also seek to boost store revenues and maintain customer satisfaction — two mandates that put additional pressure on associates.

Take a deeper look at how retailers are doing more with less in their operations in the full benchmark survey, which also dives into how retailers are tackling the ongoing challenge of theft and managing the costs of offering multiple fulfillment options.

Employee Retention Challenges Persist

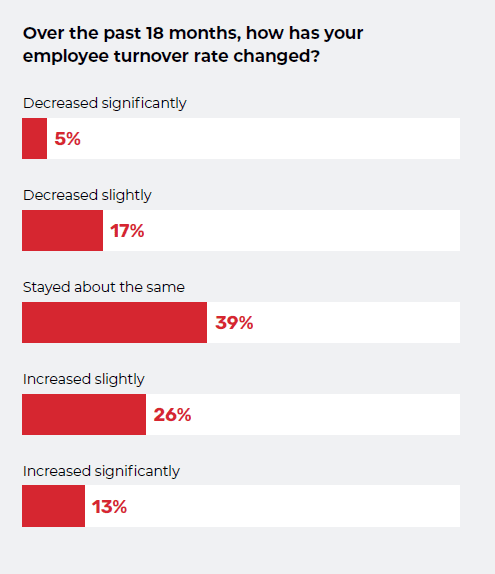

Although survey respondents reported spending more on associate-specific initiatives like hiring, retention and scheduling, retailers are still struggling to find — and keep — the best workers. In fact, nearly four in 10 respondents (39%) said their employee turnover rate has increased slightly or significantly over the past 18 months — the same number of respondents who said their turnover stayed the same.

Looking deeper into the data, 21% of respondents said their turnover rate for store-level, non-managerial employees was less than 20%. Nearly half of respondents (46%) said their turnover rate was between 21% and 50%. Although these numbers are below the industry average of 60%, turnover still has a resounding impact on the bottom line. After all, it takes time, energy and money to train new hires. Furthermore, it takes just as much (if not more) time and money to create programs and initiatives to keep them actively engaged in their work.

Diversity is Key for Employee Engagement Initiatives

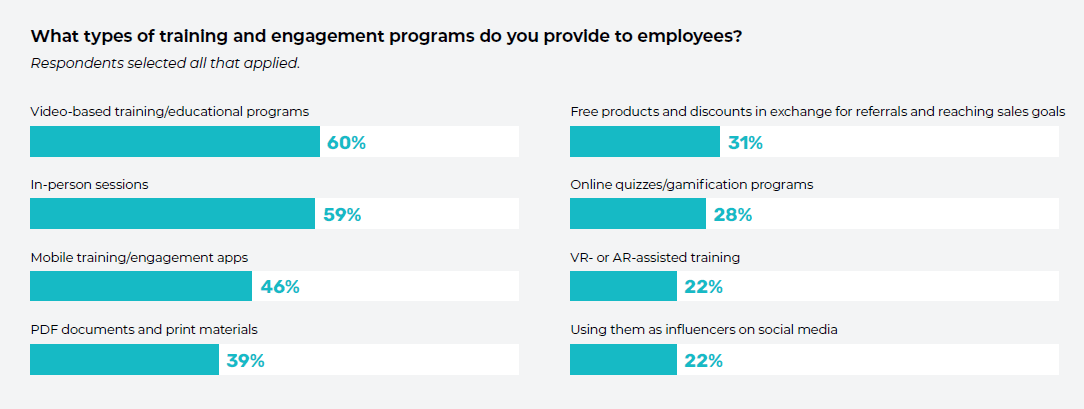

To tackle the retention challenge, retailers are investing in various training and engagement tools, from video-based sessions to VR- and AR-driven experiences. However, despite the emergence of new tools and platforms, retailers have continued to ensure there’s a balance between virtual initiatives (namely video training) and in-person sessions.

Offering employees various opportunities to engage with management, corporate leadership and each other is critical to ensuring everyone is aligned and committed to the same mission and vision. And offering these educational opportunities through different formats ensures employees can feel engaged and empowered anywhere, and at any time.

As Foot Traffic Increases, Optimized Scheduling Takes Priority

Of course, employees are one of the biggest costs of any brick-and-mortar business, so in the face of a challenging economic environment retailers also are focusing on staff allotments as they look for efficiencies in their business. To that end, retailers are increasingly focused on scheduling, a concern that increased from 35% in 2023 to 43% this year, as well as matching staff to demand, which garnered only 32% of responses in 2023 and increased to 39% this year.

According to research from Emarketer, U.S. retail and dining foot traffic has been trending up — and this is likely to continue through the holiday shopping season. Physical retail is expected to account for nearly 84% of retail sales this year nationwide, so merchants need to ensure they have the right number of highly engaged and knowledgeable associates in-store to serve ready-to-buy shoppers.

Other areas of focus as retailers look to balance their books included reducing theft (34%), decreasing employee turnover (34%) and measuring employee performance (32%).

Take a deeper look at how retailers are doing more with less in their operations in the full benchmark survey, which also dives into how retailers are tackling the ongoing challenge of theft and managing the costs of offering multiple fulfillment options.