[Editor’s note: This is the second part of a two-part series about the growth of third-party marketplaces. Check out part one of this series to find out what is driving the recent proliferation of the marketplace model.]

As online competition heats up, third-party marketplaces are proving to be a cost-effective and relatively low-risk way for retailers to expand their product offerings and capture consumer mindshare. On the surface this could look like another classic case of legacy retail chasing the success of Amazon, but in reality most of these new marketplaces take a very different form than the online behemoth.

In fact, the retailers finding the most success are actually doubling down on their own unique value propositions by using their third-party marketplace as a vehicle to draw in new customers and better meet the needs of existing ones.

Retailers looking to get the marketplace model right should:

- Focus on expansion in categories that align with core brand attributes;

- Implement a vetting process to ensure that marketplace sellers can integrate seamlessly into the core ecommerce offering; and

- Maintain control by incorporating a feedback loop and selecting sellers that are able to meet brand standards when it comes to product quality and customer service.

Expand Reach, but Within your Niche

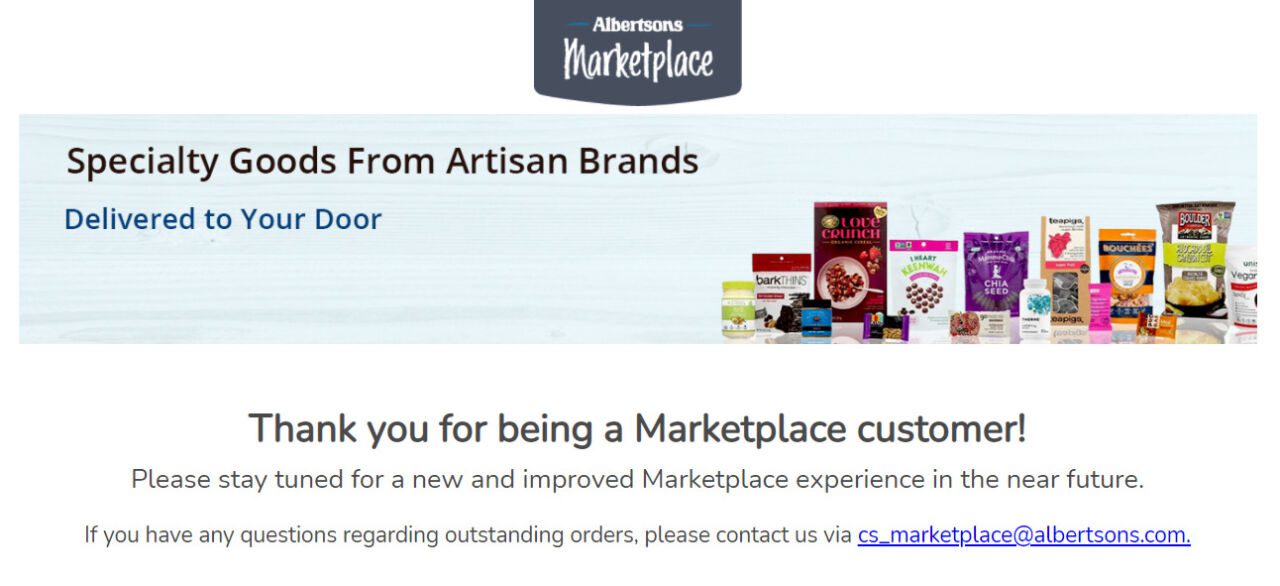

To be sure, some of the retailers debuting marketplaces are looking to compete directly with Amazon: Walmart, Target, Hudson’s Bay and the planned Debenhams marketplace (under new owner Boohoo Group) are all essentially huge digital department stores with broad category reach. But this model is unlikely to work for most retailers. Albertsons, for example — which launched its marketplace in 2018 with the goal of offering its customers more than 40,000 new specialty products — has since shuttered the operation for reasons not shared with the public.

“[Marketplaces] typically have three key features — assortment, services and community,” said Eric Gervet, Partner in the retail and digital transformation practices of Kearney in an interview with Retail TouchPoints. “If you compete on assortment alone you cannot beat Amazon. But specialized marketplaces can provide services and community that Amazon can’t deliver in every single category. If you can find an angle in services and community, then you can have an edge.”

While offering an expanded product assortment is certainly one goal for most retailers adding a marketplace, those finding the most success do so in a way that is organic to their existing niche. The key is to leverage the model to create a differentiated ecommerce experience — without losing sight of the core brand.

In fact, many third-party marketplaces are nearly invisible to the end consumer. Visit Urban Outfitters, Kroger or Michaels online and it’s hard to tell which products are first-party and which are sold by third parties.

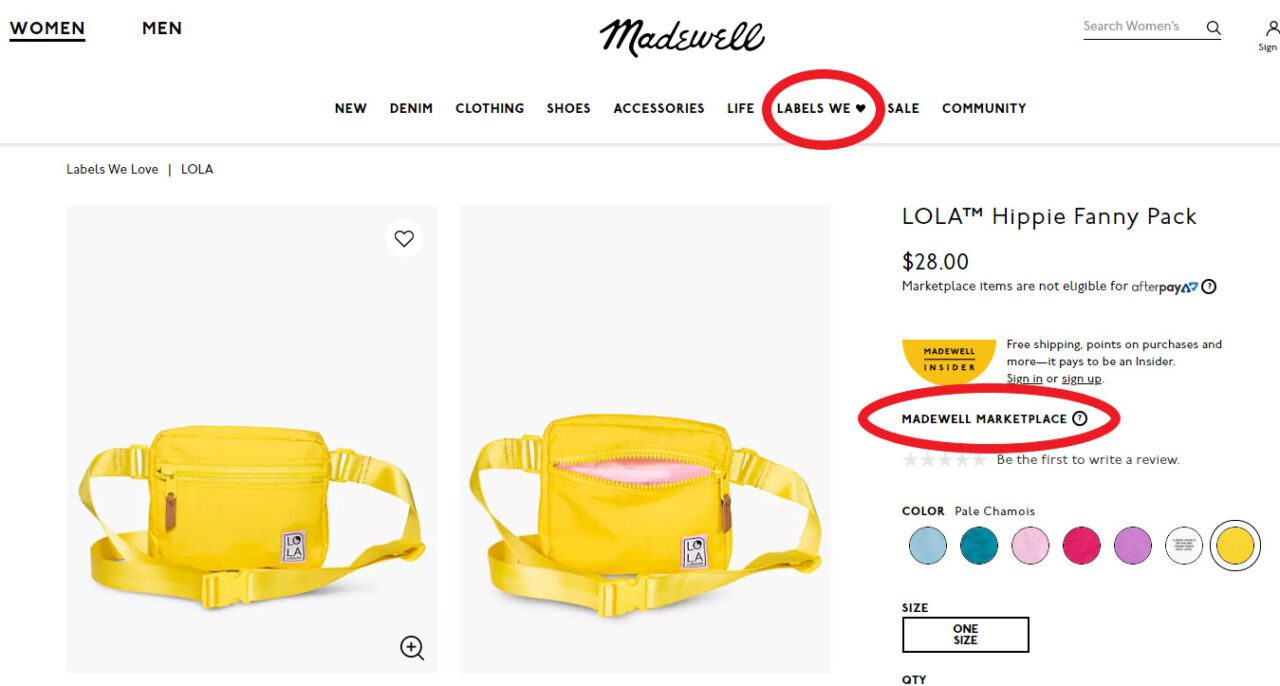

Some brands do choose a different tack. Madewell, for example, highlights its third-party sellers both in a separate section of its site and with a designation on the product listing. But beyond those distinctions, the way the products are presented is indistinguishable from Madewell’s core offerings, and site searches bring up a mix of both first- and third-party products.

Achieving Seamless Integration Through Thoughtful Curation

When Woolworths announced plans for its new third-party marketplace in April 2021, the retailer’s Director of New Business Faye Ilhan described it as “a highly curated marketplace focused on range extension in our core everyday needs categories.” Indeed, curation is central to getting marketplace implementation right.

“The key is brand alignment,” said Joe Sawyer, Chief Marketing Officer of marketplace SaaS solution Mirakl in an interview with Retail TouchPoints. “Curation is about making sure that what you offer is recognizable to your consumers as being something that is uniquely in line with your brand and the promise that you make your consumers.”

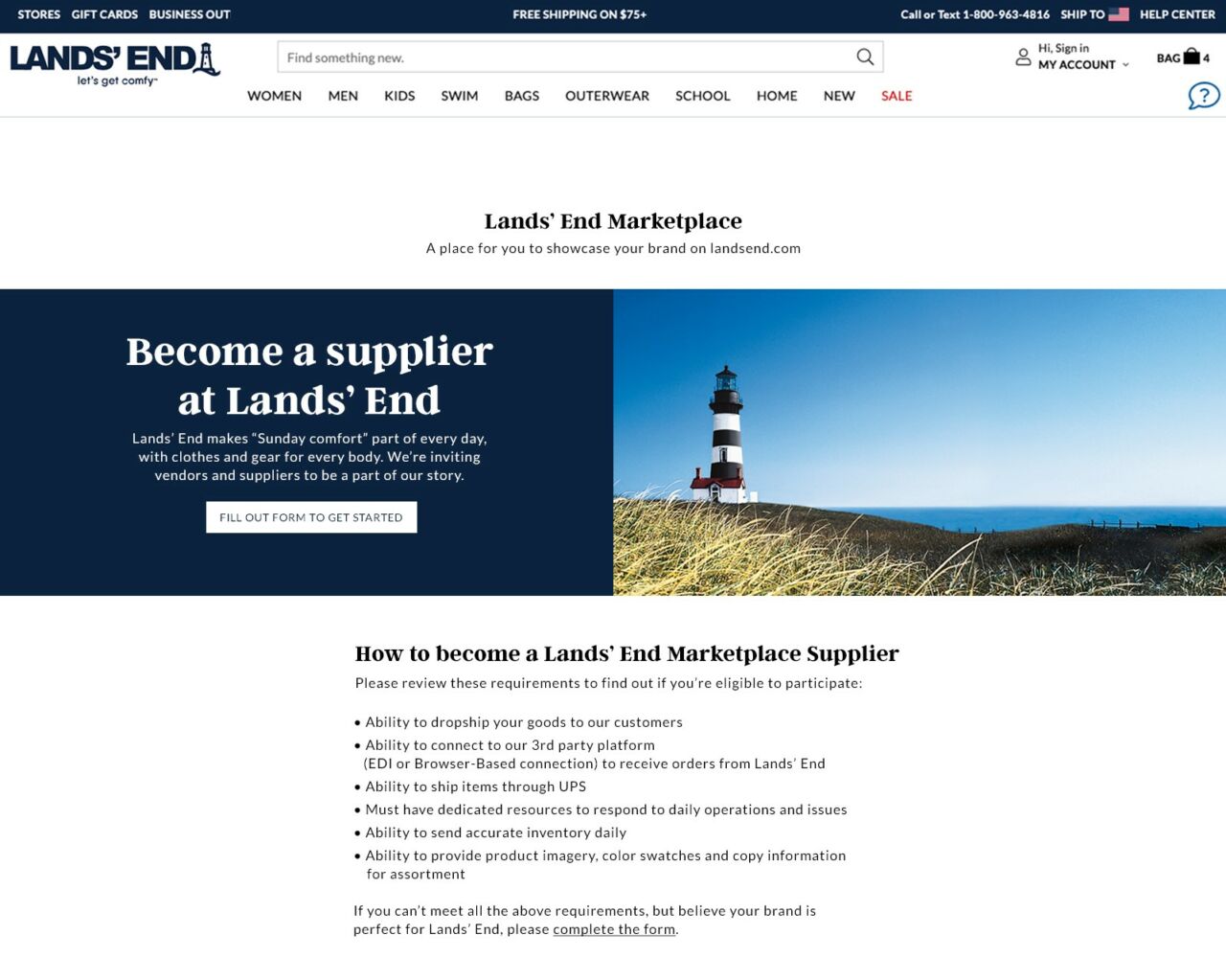

Most retailers manage this through some form of seller vetting process. In the case of Lands’ End, which launched its marketplace in March 2021, sellers can apply via an online form. Seller participation in Yahoo Shops, the upcoming third-party marketplace from Verizon Media, will be primarily invite-only according to Andrea Wasserman, the company’s Head of Global Commerce: “Whether we are vetting a national or DTC brand, we want to select brands that will sit together in a way our consumers can connect with,” she said in an interview with Retail TouchPoints.

Sawyer is careful to note that curation does not mean a limited quantity. “Curated doesn’t mean small or few in number,” he said. “It means you’re not relinquishing control, but you’re still upholding choice. For example, there are eight curators at the Louvre, and they make sure that even though the collection is massive and overwhelming, everyone who goes there can find the right experience for them. There’s been a tendency to equate curation with ‘few,’ and in fact that’s not the winning formula.”

Like Lands’ End, Hudson’s Bay invited sellers to apply online when it announced plans for its marketplace in February 2021. The platform launched two months later with vetted sellers across a set of targeted categories including apparel, home, beauty and accessories. But in the case of Hudson’s Bay’s, curation certainly definitely doesn’t mean few — the retailer said it expects to have more than 500 sellers by the end of this year.

Retailers Have the Control to Select Sellers that Meet Their Standards

Seller selection is the “critical accelerant” to marketplace success, according to Sawyer. Because marketplace sellers are often invisible to the end consumer, marketplace operators do run the risk of low-quality products or poor customer service, resulting in brand erosion. That’s why, for many retailers, relinquishing control by allowing other sellers to interact directly with their consumers can be a scary proposition. However, these dangers can be managed.

“There are a lot of things retailers can do as part of designing their marketplace that minimize these risks,” said Sawyer. “One is just understanding what the marketplace is meant to do to begin with, and therefore what kinds of sellers and what kind of assortment is going to support that.”

Lands’ End makes a number of requirements of the third-party sellers its selects to participate in its marketplace, according to Sarah Rasmusen, the company’s EVP and Chief Customer Officer in an interview with Retail TouchPoints. These include:

- The ability to drop ship goods to Lands’ End customers;

- The ability to connect to the Lands’ End third-party platform to receive orders;

- The ability to ship items through UPS;

- Dedicated resources to respond to daily operations questions and issues;

- Delivery of accurate daily inventory updates; and

- Providing product imagery, color swatches and copy information within the company’s guidelines.

“[Retailers] are able to define the business rules for their marketplace in terms of what they expect for delivery options or service responsiveness,” said Sawyer. “You can have your cake and eat it too as far as managing quality and brand relevance, without sacrificing control in an unacceptable way.”

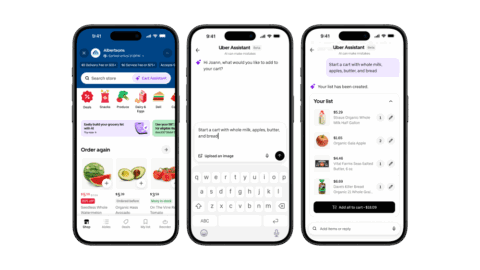

Another way to mitigate risk is to have a feedback loop in place. Kearney’s Gervet used Uber as an example: “Uber is essentially a marketplace for urban mobility, and it is better than most taxi companies for the simple reason that it has embedded the feedback loop. After every transaction, users rate the transaction, so if a driver is not performing, they get rejected by the marketplace. The same thing applies to the Amazon marketplace — if there are issues with quality or service or the product, they will be rejected, or the marketplace partners will gather the feedback and improve the next time.”

Ultimately, retailers are in control of their marketplaces, even if third-party sellers are handling the inventory and fulfillment. “For some companies this does mean pushing through some conservatism and realizing that more sellers equals more GMV and a more satisfying experience for customers,” said Sawyer. But while these marketplaces can offer huge potential for retailers to improve both the customer experience and their bottom line, careful curation, an execution strategy focused on brand alignment and a thorough seller vetting process are all critical to success.

[Read more about how other retailers are leveraging third-party marketplaces to drive growth in the first part of this series.]