Out-of-stocks continue to plague the retail industry as one of the biggest causes of lost revenue and customer frustration. Now a new research study from IHL Group has helped to quantify just how big the problem is for the industry and also identifies the biggest laggards when it comes to in stock positions.

Consumers experienced out-of-stocks during approximately 17.8% of their shopping trips, which is about 123% higher than the out-of-stock rate claimed by retailers for themselves, according to the new report from IHL Group titled “What’s The Deal With Out-Of-Stocks?”

Breaking the out-of-stock issue down by verticals, IHL Group found consumer electronics stores are losing the most, with consumers saying that they leave the store without buying at least one item 21.2% of the time. The study also found warehouse clubs lose $1.78 and grocery stores lose $.68 in sales for every customer when consumers cannot buy that product or an adequate substitute.

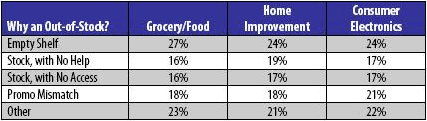

“Retailers remain in denial when it comes to consumer’s perceptions of out-of-stocks,” says Greg Buzek, president of IHL Group, an analyst firm and consultancy that serves retailers and technology vendors. “Consumers don’t care why the product is not available. They come in with money to spend at the stores and have to leave either because the shelves are empty, there is no one to help get a locked item, or the staff simply cannot find the merchandise even though the computer system says they have it. 9% of all consumers in our study have simply stopped shopping at one or more retailers in the last 12 months due to the problem.”

The study applauds those retailers who have achieved best in-stock performance by naming Safeway as best-in-class among grocers (with only 14.7% of consumers experiencing out-of-stock of at least one item); Ace Hardware as best-in-class for home improvement, (with only 13.6% of consumers experiencing out-of-stocks); and Fry’s Electronics in consumer electronics (with 13.1% percent of consumers experiencing out-of-stocks).

On the flipside, the IHL study also highlighted those retailers losing the most revenue due to poor in-stock performance. With an 18.1% out-of-stock rate, IHL estimated CompUSA is losing $1.16 for every customer, while Radio Shack, with a 22.7% out-of-stock rate, loses $1.46 per customer.

The other biggest revenue losers, according to the report, were: Office Max, which has a 30.6% out-of-stock rate and loses $1.96 per customer; Office Depot, which has a 26.6% out-of-stock rate and loses $1.67 per customer, and Circuit City which loses $1.65 per customer with a 25.7% out-of-stock rate.

IHL provides customized business intelligence for retailers and retail technology vendors, with particular expertise in supply chain and store level systems. Our customers are retailers and retail technology providers who want to better understand what is going on in the overall technology market, or wish to identify specific equipment needs for the retail market.