The rise of e-Commerce has had a major impact on more than just retailers. It has reshaped how investors, businesses and policymakers view the industry. Simply put, as brick-and-mortar retailers shrink in square footage and lose share to online sales, it becomes more difficult to quantify their performance.

Solactive, a developer of financial indices, and ProShares, a provider of exchange-traded funds (ETF), sought to change that by creating an index to benchmark the modern brick-and-mortar landscape. The Solactive-ProShares Bricks and Mortar Retail Store Index, developed in November 2017, is designed to provide a snapshot of how the market views the health of the sector.

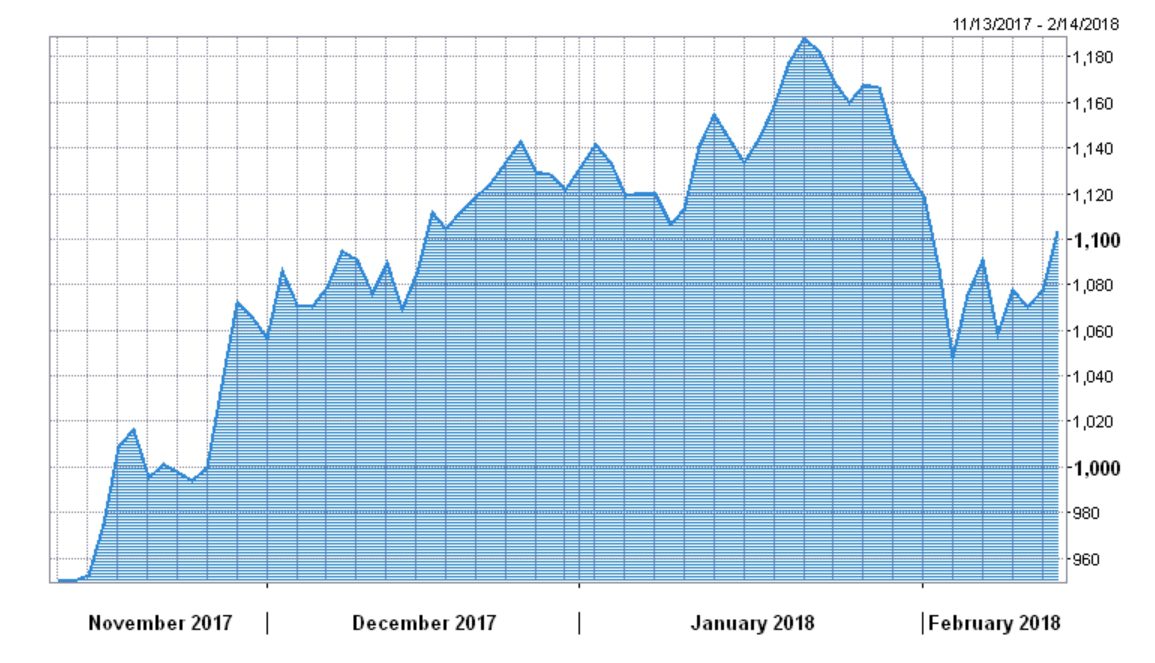

As of market close on Feb. 12, the Solactive-ProShares Bricks and Mortar Retail Store Index (SOEMTYTR) has experienced Net Asset Value (NAV) returns of 12.67% since inception (11/14/17) and -4.54% year-to-date (YTD). The YTD drop coincides with the U.S. Commerce Department’s report that January 2018 retail sales decreased 0.3%, the largest such dip in 11 months.

Retailers in the index derive 75% or more of retail revenue from in-store sales. Qualifying retailers have a market capitalization of more than $500 million and an Average Daily Traded Value of more than $1 million during the six-month period prior to the selection date.

The brick-and-mortar index includes major retailers such as: Walmart, Barnes & Noble, Gap, Office Depot, Sears, Macy’s, Nordstrom, AutoZone, Costco, Dollar General, Best Buy, JCPenney, Home Depot, Tiffany and Target.

ProShares has not ignored the digital side of retail. The company developed an online retail index to track both U.S. and non-U.S. retailers that primarily sell online or through other non-store channels. Companies need a minimum market capitalization of $500 million to be listed. The online retail index includes brands such as Amazon, Alibaba, eBay, Etsy, HSN and Wayfair.

Unsurprisingly, The ProShares Online Retail Index (PSONLINE) saw bigger returns than its brick-and-mortar counterpart, experiencing NAV returns of 18.20% since inception and 10.24% YTD.

A third index, the ProShares Long Online/Short Stores Index, combines both of those specialty retail indices into one. The ProShares Long Online / Short Stores Index (PSCLIXTR) has experienced NAV returns of 12.6% since inception and 12.89% YTD.