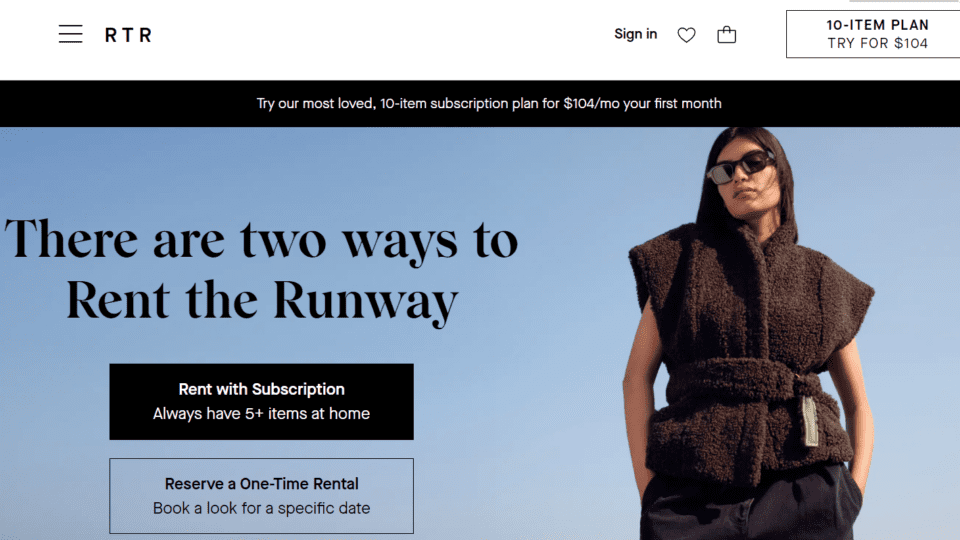

Rent the Runway has lowered its revenue expectations for 2023, now saying it plans to at least match 2022 revenues of $296.4 million. This number is approximately 9% to 10% lower than original projections, which forecast 2023 revenue in the range of $320 million to $330 million.

While company leadership argued that the adjusted forecast was necessitated by changes that would further its long-standing goal to reach profitability by 2024, shareholders were largely unimpressed by the news, with stock prices declining as much as 30% following the earnings release on Sept. 8, 2023.

As Co-founder and CEO Jennifer Hyman pointed out, profitability was actually up in Q2, which ended July 31, 2023, and net losses declined, although Q2 revenue was down slightly (1%) from the same quarter last year, to $75.7 million.

“For some time, we have been focused on taking decisive actions with the goal to bring Rent the Runway to profitability, and we believe now is the right time to accelerate our efforts,” said Hyman in a statement. “We made significant progress in Q2 across the bottom line, exceeding our profitability guidance, and with Adjusted EBITDA margins hitting a historic high at 10.2%. We believe that a key part of achieving our profitability milestone is prioritizing the medium- and long-term health of the business over short-term revenue gains and lower margin customers.”

Among the strategy shifts planned for the second half of the year that will impact overall revenues are a reduction in the number and length of promotions, focusing on rebuilding the high-margin Reserve business and cutting back on marketing spend. The anticipated result, said Hyman, is a negative short-term impact on both revenue and subscriber numbers.

“Slower revenue growth will not mean slower progress on profitability for Rent the Runway,” said CFO Sid Thacker on the Q2 earnings call. “In fact, one reason for our reduction in revenue guidance for fiscal 2023 is our decision to prioritize more rapid progress on profitability by reducing promotions and therefore, subscriber acquisition.”

“The nature of our business model is we have one pool of inventory, so if we promotionalize the lower-margin customer to come in to Rent the Runway, not only are we provisioning extra inventory for them, but they may very well take the best inventory,” explained Hyman on the call. “And they may take the best inventory away from some of our more loyal higher-margin customers. We are prioritizing the higher-margin customers, we’re prioritizing the overall customer experience, and we don’t want to either market into or promotionalize into lower-margin customers [who may] come in and grab the very inventory that is critical for the experience of our better customers.”

“We want to get to free cash flow break-even as quickly as possible, so we’re taking the actions that we need to to not only fundamentally improve the quality of acquisitions coming in but be more efficient about product acquisition for those qualified customers, and then making sure that we can actually deliver the best experience possible for both customers,” added Thacker. “If we do all of those things right, that feedback loop — given that 80% of our customers come to us organically — will end up driving additional organic acquisitions in a more efficient way.”