To say that year-over-year traffic results for Black Friday Week were soft would be an understatement. It was a very tough couple of days for brick-and-mortar retailers. However, looking a little deeper and putting them into context along with some of Sensormatic Solutions shopper survey data might provide some welcome light as we travel to the end of the holiday traffic tunnel.

To say that year-over-year traffic results for Black Friday Week were soft would be an understatement. It was a very tough couple of days for brick-and-mortar retailers. However, looking a little deeper and putting them into context along with some of Sensormatic Solutions shopper survey data might provide some welcome light as we travel to the end of the holiday traffic tunnel.

Black Friday Weekend vs. Spring 2020

But first, a little recent history. The worst of the pandemic — the very bottom of the retail traffic journey — occurred the week of April 12, 2020, when year-over-year traffic was down 83%. From the end of the spring into the summer, traffic made a comeback by steadily rising from the -50%’s through the -30%’s. After Labor Day, in-store traffic has consistently flirted with -27% per week right up until the week before Thanksgiving.

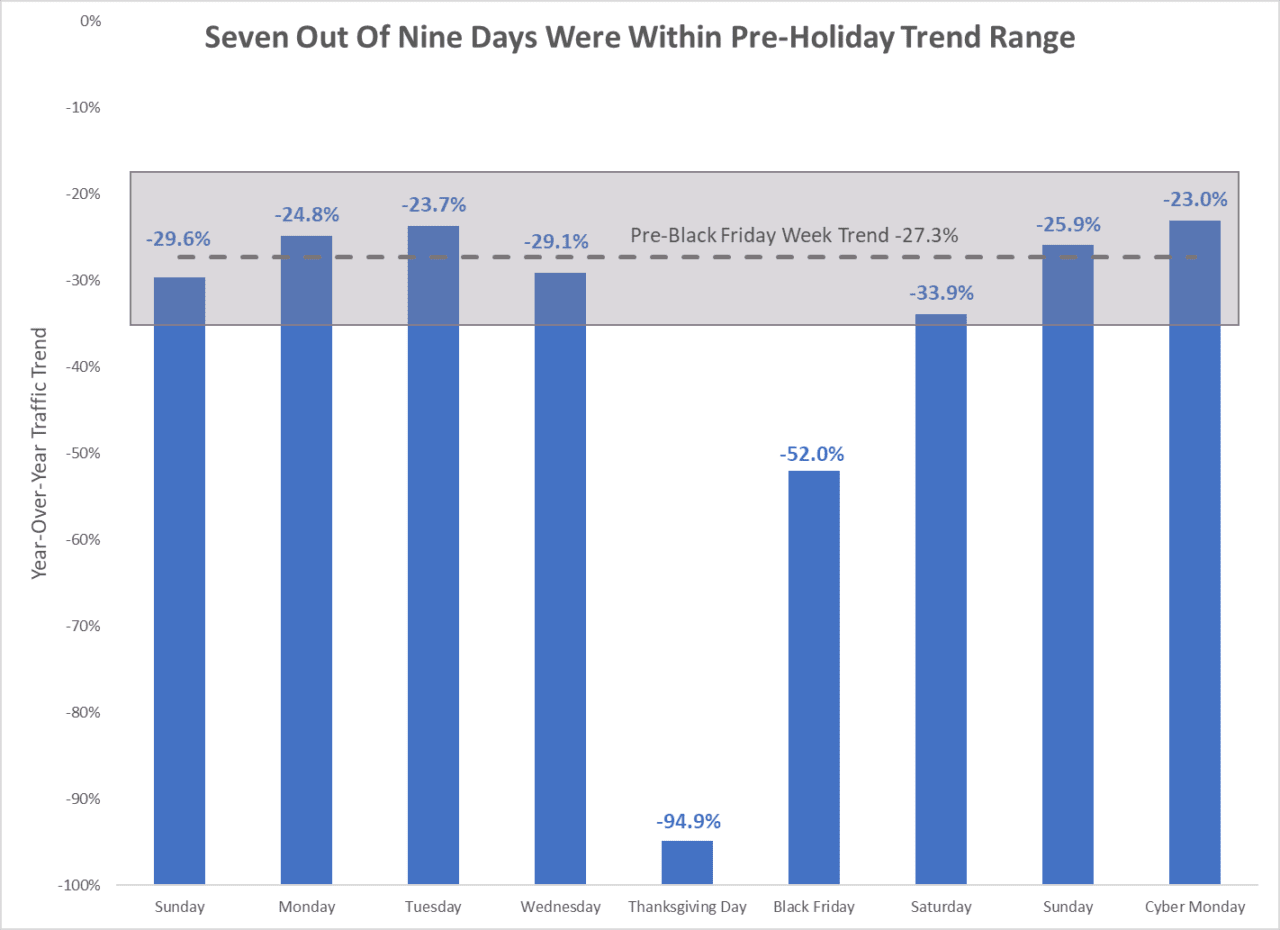

Sunday through Wednesday of Thanksgiving Week started out consistent with the current trend: averaging right around -27%. However, shopper traffic on Thanksgiving Day (Nov. 26) and Black Friday (Nov. 27) dropped considerably in comparison to last year. Thanksgiving Day was down- 95%, while Black Friday was down -52%. We saw steady improvement over the weekend as Saturday (Nov. 28) and Sunday (Nov. 29) were closer to recent trends, at -34% and -26% respectively. Overall, the four days from Thanksgiving through Sunday were down -49% compared to 2019. Breaking from the trend was Cyber Monday (Nov. 30), which was only down -23%. That means seven out of the nine days were within range of the pre-Black Friday 2020 trend.

Black Friday and Thanksgiving Lessons Learned: Shoppers are Avoiding Crowds

So how should we feel about these results? Is the in-store season doomed this year? I think a little more context is necessary before we decide to throw in the towel.

Let’s take the easy one, first: Thanksgiving Day. Yes, retail almost lost all traffic from last year. This was a given considering most major retailers and shopping centers decided to stay closed this year to give some time back to their associates. It’s only since 2013 that Thanksgiving Day shopping started to become an event, and judging from the fact that it has only contributed 1.5% to 2.5% of the overall six-week holiday shopper traffic, it wasn’t that much of an event in the first place. Losing 95% of roughly 2% of traffic is not that significant over the course of the entire holiday season, and could possibly be made up later in the season (more on that later).

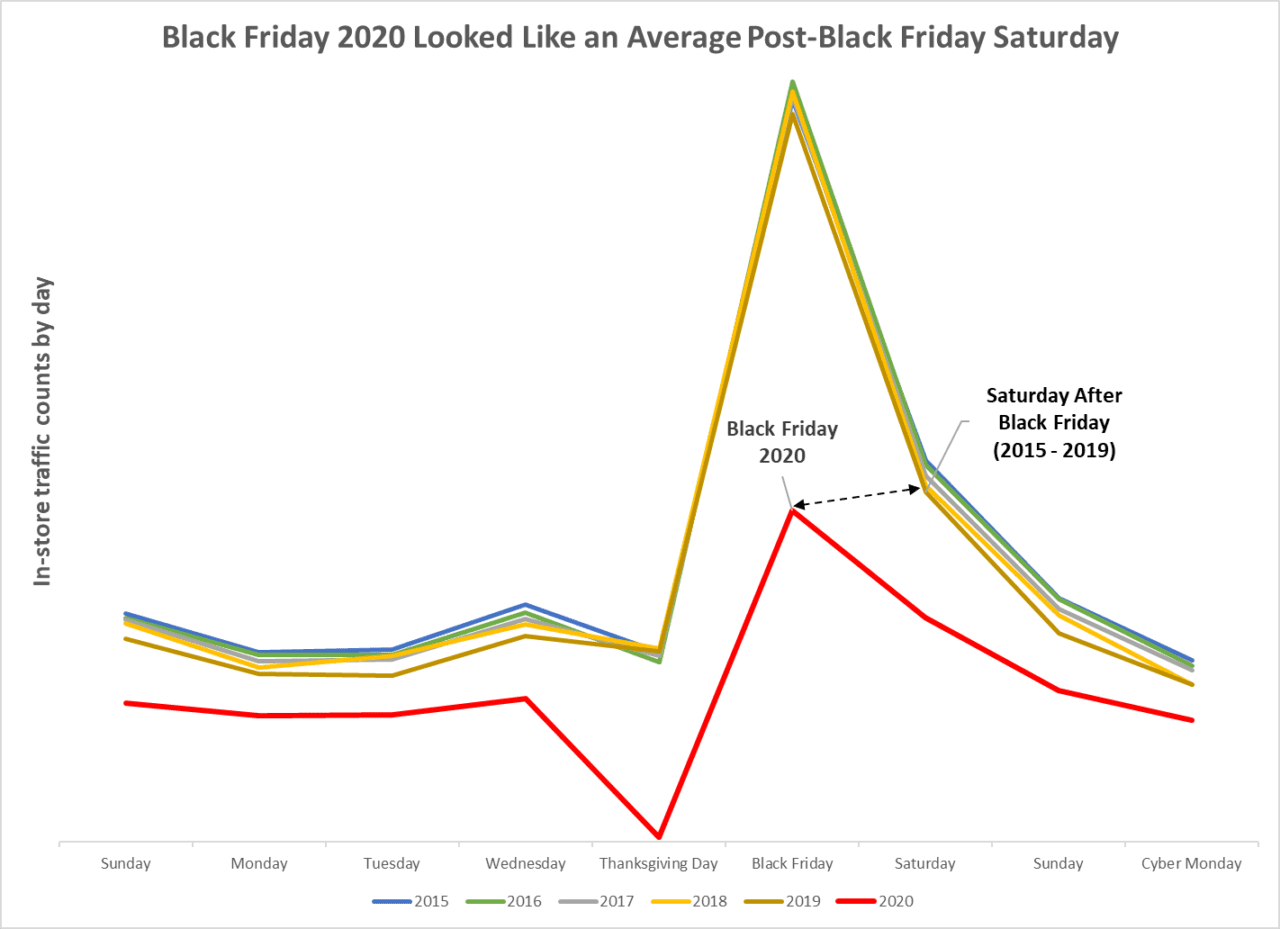

Black Friday, on the other hand, hurt — with only half as much traffic as in 2019. From a pure traffic count basis, it looked more like a typical Saturday after Thanksgiving rather than a Black Friday. There’s no way to dress that one up, except that shoppers have been telling us for months that they did not intend to go into stores on Black Friday. Here are a couple of statistics from our pre-holiday consumer survey:

- 74% of shoppers said that they began shopping before Black Friday (43% by the end of October)

- 54% of shoppers did not plan to shop on Black Friday Weekend this year

- 67% of shoppers expected to shop less in store than last year

- 80% of shoppers are leveraging buy online, ship to home

Since the numbers are high for early shoppers and the majority of those surveyed said that they were not going to visit stores, the actual traffic results should not come as any surprise. We’ve been saying for a while that due to coronavirus concerns, seasonal in-store traffic by day would likely flatten out, and that while in past years the Top 10 shopping days would together amount to nearly half of total seasonal in-store traffic, that this year the number would be closer to one-third. This means that the drop in Black Friday traffic may benefit other, later dates before New Year’s.

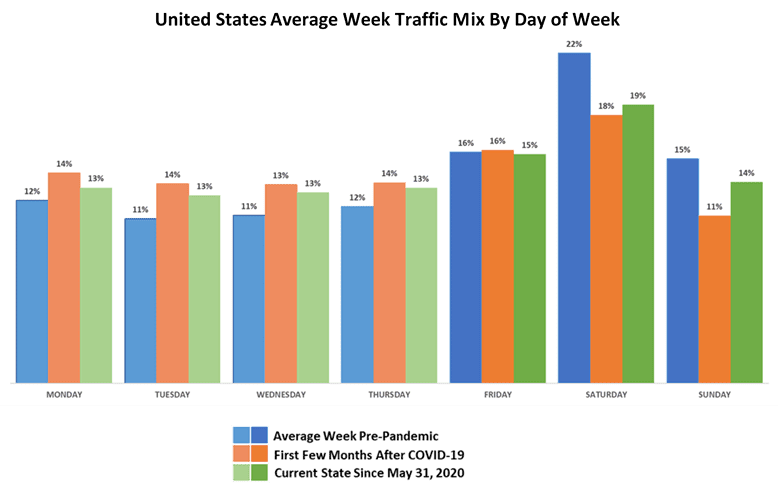

Before the COVID-19 outbreak, weekends in the United States accounted for roughly 53% of in-store traffic every week, with Saturdays at 22%. Since the beginning of the summer, those numbers have been trending to only 45%, with Saturdays at 19%. This shift by the consumer was intentional: they told us that they wanted to find less crowded stores to support better social distancing. Those two attributes are the opposite of what shoppers would expect from Black Friday Weekend. However, there are still five weeks to go until the end of the year, and plenty of weekdays to get out and shop in a similar pattern to the 55% mix that have been shopping on weekdays for quite a while now.

Let’s also take a moment to recognize that some of the Black Friday drop was intentional by retailers, who changed their selling strategies by extending promotions before and beyond Black Friday itself and encouraging shoppers to shop when they wanted to shop and through whatever channel they felt most comfortable with. This was not only a socially responsible effort by retailers, but it also took the pressure off shoppers needing to be early in line at brick-and-mortar stores for doorbusters, because there weren’t any.

The Rest of the Holiday Season

The Black Friday Weekend kickoff to the 2020 holiday retail season was soft from a traffic perspective, but the rest of the period bears watching. If the weekday traffic gains of the past few months are an indicator, then we should continue to see weekdays outperform weekends. The net effect will be a flattening of the traffic curve, which in prior years was heavily weighted to the three or four Saturdays leading up to Christmas Day, plus Christmas Week itself.

Speaking of Christmas Week, two factors may intensify in-store shopper activity as that week approaches. Retailers are already warning shoppers to get out early to avoid shipping delays. As the cutoff to ensure holiday delivery approaches, shoppers may decide that going to stores (whether to shop inside or to pick up curbside) is their best guarantee for gift-giving. Additionally, if retailers decide to accelerate season-ending discounts, that could also drive in-store traffic as we approach Christmas Day.

We still believe that at the end of the season, Black Friday will maintain its hold as the top traffic day. There just won’t be as significant of a gap between it and the #2 day, which is likely to be Super Saturday (December 19). If the top days flatten out in comparison to the rest of the season, we could still see numbers similar to where we were as the season started — in the mid -20% range. That’s an impressive turnaround compared to the hole we were in last April.

Brian Field is the Senior Director of Global Retail Consulting at Sensormatic Solutions, where he oversees the application of their proprietary traffic insights solutions to retailer-specific issues across different functional areas in order to drive top and bottom line store performance. Prior to joining Sensormatic, Field served in roles of increasing responsibility at Chico’s FAS Inc., including as the Director of Corporate Store Operations and Finance. Field has spent nearly four decades in the industry, and his experience includes: store sales and management, training, merchandising, strategic planning and analysis for brands as diverse as David’s Bridal, Circuit City and Macy’s.