Last week, news broke that Fab.com was letting go up to 90 employees based in NYC in its latest round of cutbacks.

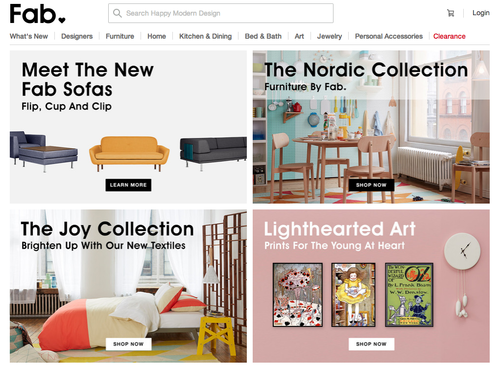

The flash sale / daily deal retailer has struggled over the past few months to rebrand itself, offering its own line of furniture and a pop-up showroom in NYC.

In light of Fab.com’s turbulent period, the RTP editorial team pondered: Is this marking the end of the flash sale as we know it? The editors share their feedback below:

Debbie Hauss, Editor-In-Chief: Flash sales, or Deals of the Day, are not a flash in the pan since they gained popularity when Woot made a splash as far back as 2004. But this retail model has its ups and downs. Daily deals can offer a quick boost in sales and revenue for small businesses, but they’ve also been known to put small businesses out of business. And while Fab.com is laying people off, Australia-based MySale just agreed to purchase UK-based Cocosa from Mohamed Al Fayed. Now, with a 800,000 strong customer base, MySale is planning to open a new flash sale site in the UK. I think the jury is still out on the flash sale model.

Alicia Fiorletta, Senior Editor: Full disclosure, I will say that I’m an avid flash sale shopper, and a fan of Fab.com. I think the eTailer has a lot of fun and unique pieces, especially in the areas of wall art and home decor. However, I think the struggle for the home category is that furniture is a big purchase (no matter how good the deal). Since this is the new focus for the company, the pop-up showrooms are a smart idea. I also think this may be a general branding issue rather than a company issue. Rue La La, Gilt and even Zulily have very specific target customers. The online shopping experience, content and marketing are aligned appropriately. I think if Fab.com focuses on engaging folks who love modern design and appreciate interior design, there could be a new and exciting path for the company moving forward.

Kim Zimmermann, Managing Editor: There will always be consumers hunting for bargains, so I don’t think that the flash sale/daily deal model will ever go way. It was in place long before the Internet, for those of us who remember the Kmart “blue light specials.” The sense of urgency and limited offers draws customers, no matter the format. I do think we will see retailers taking matters into their own hands more often, conducting their own flash sales and daily deals rather than leaving it to third parties.

Glenn Taylor, Associate Editor: Flash sales seem to be a mixed bag based on the business model at hand, and the industry as a whole constantly changes. Fab is a primary example of the industry’s volatility, as the company had completely changed its business model multiple times over a two-year period. Increased holding costs for unsold inventory certainly can create a burden for these sellers, especially if they are relying on specific products to bring in revenue. Companies like Gilt and Zulily have been able to keep the flash sale idea fresh by introducing private-label merchandise to their selection, showing there is still potential for retailers to adapt their business models appropriately.

Brian Anderson, Associate Editor: In my opinion, flash sale sites grew in prominence back in the day because they catered to a spontaneous shopping style that was slowly growing alongside other retail innovations – especially the growth of mobile and the “constantly connected” consumer. Nowadays, shoppers expect these types of daily deals, and many retailers have started organizing and managing their own flash sales instead of working with a third-party. With big-name retailers – Walmart’s Value of the Day comes to mind – driving their flash sale efforts, daily deal sites look to the SMBs in order to turn a profit. In the end it’s a gamble, and Fab.com seems to have gotten the short end of the stick.