Who will win the battle of omnichannel retail? For more than a decade, retail analysts and industry watchers have been observing the race between the two biggest players in the space — Amazon and Walmart — and making predictions about which company will ultimately “win.”

Who will win the battle of omnichannel retail? For more than a decade, retail analysts and industry watchers have been observing the race between the two biggest players in the space — Amazon and Walmart — and making predictions about which company will ultimately “win.”

Here’s our prediction: They’ll both continue to set the standard for omnichannel commerce. That’s not because we expect them to battle to a tie, but because they’ve mastered different aspects of the omnichannel trilemma. And there are lessons in that for every omnichannel retailer that wants to stay competitive in the space dominated by these two titans.

Facing The Omnichannel Trilemma

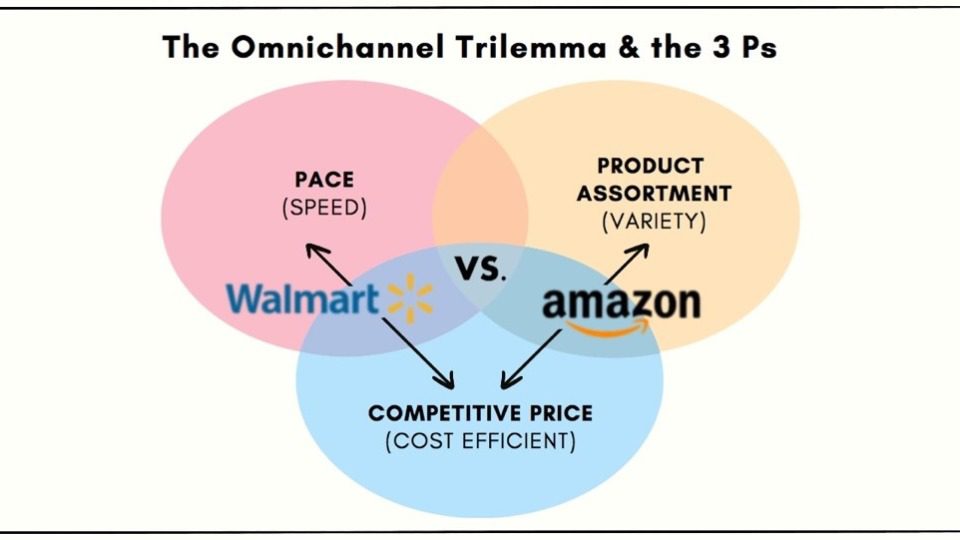

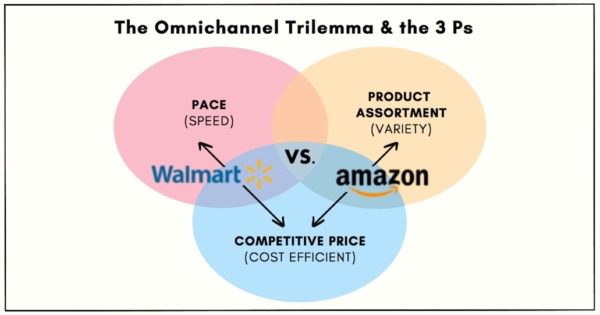

Every omnichannel merchant faces a trilemma: meeting or exceeding customer expectations for pace of delivery, product selection and price while turning a profit.

This is a balancing act, because while every customer wants the greatest product selection, delivered as quickly as possible for the best price, so far retailers can only satisfy two of the three expectations and remain profitable.

For example, a huge selection delivered at near-real-time speed won’t be profitable if the retailer is also committed to offering the lowest possible price. And the lowest-price retailer may only be able to offer the best deals by forgoing costly same-day delivery options or offering a smaller, more curated range of products.

If delivering all three Ps to customers isn’t feasible yet, how can any retailer win? By following the examples of Walmart and Amazon. Each company has evolved to excel at delivering on two of the three Ps, based on its target market and its customers’ preferences.

Walmart, Amazon And The Three Ps

Amazon and Walmart approach pace, product selection and price solutions differently. Each approach appeals to different groups of consumers.

Pace: now versus on the way home

Amazon leads in rapid delivery, with one-hour Prime Now delivery in many markets and same-day or next-day delivery available on millions of products. This rapid delivery is possible because the company has spent years and millions of dollars creating a network of local distribution points as well as offering Fulfilment by Amazon (FBA).

Despite having an enormous network of brick-and-mortar stores and distribution centers, Walmart hasn’t yet gone head to head with Amazon on one-hour delivery of non-grocery items. Walmart’s pace strengths are free same-day in-store pickup for in-stock retail items and free ship-to-store delivery for its larger catalog of online products.

Price: convenience versus lower cost

Walmart’s free in-store pickup options appeal to price-sensitive shoppers who don’t mind dropping by the store while running other errands or on their commute. This model makes economic sense for Walmart, because pallet deliveries to the store are cheaper than individual package deliveries to customers.

Meanwhile, Amazon Prime customers are willing to spend $119 a year on membership fees in order to get their items as quickly as possible. And Amazon’s super-fast delivery options come at a steep price. In 2017, the company reported spending $21.7 billion on shipping. Its Q4 2019 spend for one-day delivery alone will total nearly $1.5 billion — cutting into profits to establish long-term dominance in this area.

Product selection: nearly everything versus enough for most shoppers

When it comes to product selection, Amazon’s marketplace model allows it to offer many more items than Walmart. In 2017, Amazon offered an estimated 375 million products, including items from marketplace vendors, while Walmart offered 23.5 million from its stores, distribution centers and third-party online sellers.

Realistically, both companies offer a vast amount of choice. But because it’s not cost-effective for Walmart to stock hundreds of millions of SKUs in its stores and warehouses, it focuses on the items its shoppers want most. Amazon, meanwhile, appeals to shoppers who are very specific about what they want.

Amazon And Walmart Are Both Winning

Neither retailer has solved all three challenges of the omnichannel trilemma, but they’ve found ways to satisfy their customers by solving two out of three. For Walmart it’s pace and price. For Amazon it’s product selection and pace.

Viewed this way, the two retailers seem complementary. Amazon has a better value proposition for higher-income customers who want convenience and variety. Walmart has a better value proposition for customers with lower incomes who want quick pick up and the lowest possible prices.

Neither needs to vanquish the other — they can coexist and gain market share by solving different problems for shoppers.

What Can Other Retailers Learn From Amazon And Walmart?

Solving all three elements of the omnichannel trilemma may not be possible or necessary to thrive. The key is understanding what your customers want, what they’re willing to pay for, and how you can use that knowledge to differentiate your brand from your competitors.

Your brand’s background can help you stand out in the omnichannel space, too. After all, Walmart versus Amazon is the story of convergence to omnichannel retailing, with Walmart coming from brick and mortar stores and Amazon coming from pure play e-Commerce. Over time, both have moved in the same direction following the customer’s digital transformation, bringing strengths based on their origins.

Omnichannel also offers opportunities that didn’t exist before digital retail and big data. A/B testing, buy online/pick up in-store (BOPIS), real-time data analytics in marketing and merchandising can increase conversion rates. AI-driven recommendation and personalization can more accurately customize each customer’s experience online and in-store. Complex inventory and logistics optimization problems are an opportunity to differentiate. Both Amazon and Walmart have seized these opportunities to serve their customers better.

The convergence that Amazon and Walmart illustrate — and the new impact of analytics and AI on omnichannel — shows that the brick-and-mortar versus online distinction is not where any retail battle will be won. Instead, businesses that thrive will build a unified commerce strategy that draws on their existing competitive advantages and lets them pivot their strategy as consumer habits and technology keep evolving.

Alexandre Soncini serves as the North American GM of VTEX, the leading global commerce platform that unifies customer experience into one comprehensive enterprise solution. Soncini brings over 20 years of experience in the digital commerce industry and a passion and appreciation for the accelerated transformation of brands and retailers. As a founding employee, he has successfully propelled the company’s expansion and dominance in Latin America, currently serving over 2,500 online stores in 30 countries. Soncini is now leading the company’s strategic North American expansion. For more information visit: https://vtex.com/us-en/, or follow on Twitter @vtextruecloud.