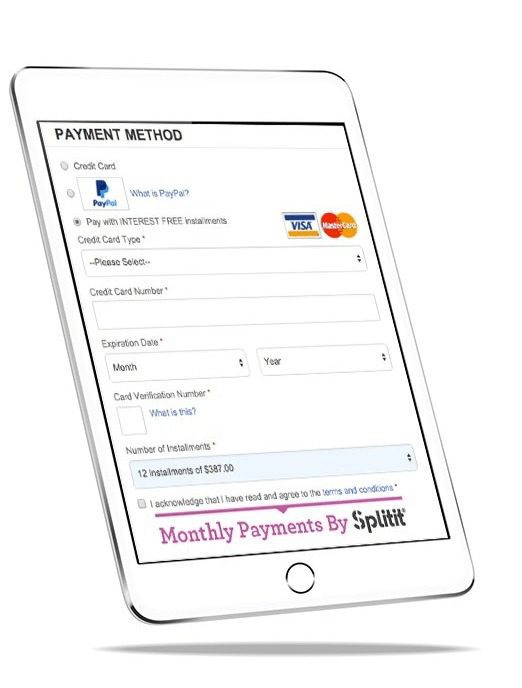

Splitit has released a payment tool that allows online and in-store retailers to leverage unused credit lines, by offering their customers the ability to pay in interest-free monthly installments on their existing Visa and MasterCard credit cards, with no credit check process required.

Splitit has released a payment tool that allows online and in-store retailers to leverage unused credit lines, by offering their customers the ability to pay in interest-free monthly installments on their existing Visa and MasterCard credit cards, with no credit check process required.

The service works as an intermediate layer between the merchant’s platform and its existing payment gateway; installment transactions are sent to Splitit, which will then relay the transaction to the existing gateway.

At the checkout, a customer will pay for their purchase using Splitit to create an installment plan. Here’s how the plan works:

-

Splitit authorizes the full amount of the purchase on the shopper’s existing credit card and holds their credit line for the entire amount;

-

The first installment is charged a few seconds after the purchase authorization or upon shipping;

-

Splitit reauthorizes the outstanding amount when the previous authorization is about to expire; and

-

Splitit will charge the shopper’s credit card every month until the plan is finished, reducing the hold on their credit line each month by the payment amount.

Retailers can integrate the Splitit platform within five ways:

-

Web API;

-

Embedded code;

-

A virtual POS;

-

A Magento extension; or

-

A WooCommerce plugin.