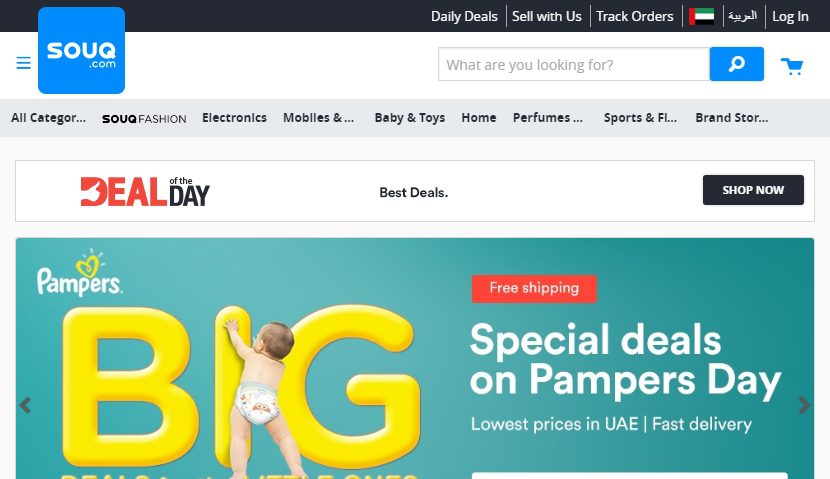

Amazon has already established dominance in the U.S. and Europe and is getting serious in India and China, but it has now set its sights on another major region: the Middle East. The e-Commerce giant has acquired Souq.com, one of the largest online sellers in the region, according to numerous reports.

Souq.com was reported to be valued at $1 billion at the time of its latest $275 million funding round last year, but the acquisition reportedly cost Amazon $650 million. The e-Commerce retailer and marketplace presently delivers to seven countries, including UAE, Egypt, Saudi Arabia, Kuwait, Bahrain, Oman and Qatar. Neither retailer has commented on the acquisition.

The pairing would give Amazon the large footprint it needs to enter the Middle East without starting from scratch, which is usually how the retailer expands into a new market. By taking an acquisition route, Amazon won’t have to obtain the same number of regulatory approvals that would be required of an individual foreign business, nor will it have to partner with as many vendors and suppliers.

As part of the deal, Amazon takes over the Fulfilled By Souq logistics operation as well as online payments platform Payfort, enabling the company to gain local expertise on operating in the region, all while acquiring an existing customer base.

The acquisition also comes at a good time strategically. While e-Commerce only represents approximately 2% of retail sales in the Middle East, there is massive growth potential for the $20 billion e-Commerce market, which is expanding 30% per year as credit card adoption and mobile penetration continue to rise.

Other players are looking to take advantage of the expanding market. Saudi Arabia’s Public Investment Fund and Dubai-based real estate tycoon Mohamed Alabbar, whose firm owns The Dubai Mall and the Burj Khalifa, have collaborated to invest $1 billion into competing e-Commerce venture Noon.

Retailers always face a quandary in competing with Amazon, but this is a situation where very few brands have the resources to measure up. While $650 million is a large sum for any acquisition price, Amazon’s $405 billion market cap makes the purchase a mere drop in the bucket as the cost of entering an unknown but promising market.