By Brian Anderson, Associate Editor

One of my biggest pet peeves is the number of cards I have in my wallet. My wallet is often so disorganized that I’m confident a thief wouldn’t be able to find anything of value without putting a lot of time and effort into it.

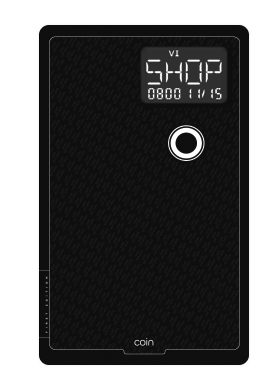

Coin, a device that can hold and use the credit card information of up to eight cards, is designed to remove unnecessary clutter in your wallet with the convenience of a single card. Although the convenience will likely be tempting for a lot of consumers, including me, this startup could be in store for some unexpected turns, before the concept takes hold. Here’s a list of three snags Coin needs to address before it can launch into a successful company.

1. The Startup Struggle: Coin states on the company web site that its product will become available to the public in the Summer of 2014, but the company needs to make sure it meets all the guidelines and has all the necessary certifications before it can even consider filling up the delivery trucks.

According to the company FAQ, Coin is still in the process of receiving its PCI DSS certification, a certification every merchant must obtain if they accept payment via credit card. The detailed compliance requirements depend on which acquiring bank and card brands Coin does business with. This is a problem because none of the major credit card companies have announced that they will be partnering with the company.

Also, Coin is accepting pre-orders from customers in order to “reduce risks and help ensure that [Coin] delivers the best possible product and customer service.” Without these certifications — however — the company will not be able to provide their product, potentially tarnishing its brand image if Coin has to push back its launch date.

2. The Security Snags: With Target, Neiman Marcus and Michaels Stores suffering from major data security breaches in the past month, companies are putting a lot of time and effort into making sure customer data is safe and secure. Coin has a security measure which deactivates the device after it has spent a pre-decided amount of time away from the user’s mobile device.

Although the feature does its job, making a product inoperable when you don’t have your phone could lead to some inconvenient experiences that can upset customers. It’s true that today’s consumers are constantly connected to a mobile device, but there are always instances when your smartphone isn’t by your side. Coin can only be paired with one mobile phone at a time — meaning if your phone is damaged or lost, your Coin is turned off until it is replaced or paired with a new phone; Being stranded with a dead Coin and no phone will not sit well with consumers.

3. The Durability Queries: Compared to debit and credit cards offered by banks, Coin is constructed from durable material that makes it water resistant and unable to be targeted by certain card skimming threats. But there are two things that can be considered turn-offs to customers when it comes to the Coin’s durability: time and money.

Coin runs on a built-in battery that is unable to be charged; meaning once the battery dies, you need to purchase a new Coin. The company states that its device can last up to two years, depending on how frequently it’s used. With normal credit cards averaging a three-year validity, customers could see the two-year lifespan in a negative light. Also, each Coin will be selling for $100. While most banks renew credit cards for free, the price tag might not be worth the potential convenience that Coin offers.

Although the concept behind Coin is something that may be impacting the payments industry in the future, it is too early to tell whether or not Coin will get up and running without too many snags. But each problem mentioned above can be ironed out far before the product officially launches, leaving the startup with the potential to gain publicity and a loyal fan base.

What do you think about the potential of Coin? Let me know on Twitter via @G3Brian!