By Glenn Taylor, Associate Editor

To close out #RIC16, Maureen Mullen, Chief Strategy Officer and Co-Founder of L2, made a blunt statement reflecting the state of the retail industry today: “It’s going to be increasingly difficult to compete in e-Commerce without an omnichannel strategy.”

Where once the message to brick-and-mortar retailers was to get online as quickly as possible, today it’s the pure play merchants who are being advised to establish a physical presence — and to do it quickly. Online-only retailers need to differentiate themselves from the industry’s behemoth, Amazon, as much (if not more so) than more traditional enterprises.

Amazon’s clout can’t be overstated: The retailer accounted for a whopping 24% of the entire industry’s sales growth in 2015. On top of this, Amazon has a 36% share of online sales among the top 50 U.S. e-Commerce retailers.

Stores Provide Path To Profitability

Even as total e-Commerce purchases continue to increase year-over-year, the store’s influence can’t be denied, particularly when looking at the success of retailers that have gravitated away from online-only sales.

“Stores aren’t an expense,” Mullen said during her presentation. “Stores are a path to profitability.”

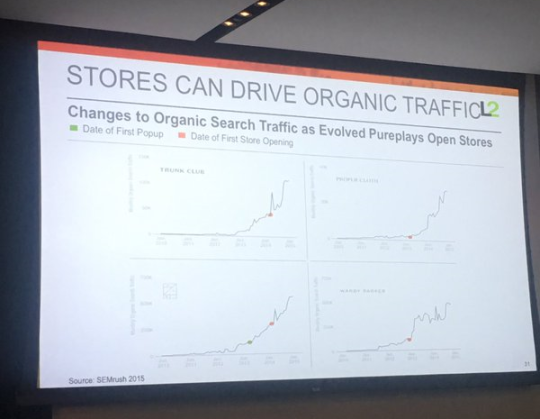

In the case of once-pure play retailers such as Trunk Club, Warby Parker, Proper Cloth and Rent The Runway, their organic search traffic online shot up tremendously as each merchant opened up their own brick-and-mortar stores. With organic reach becoming more of a challenge as retailers flood the market, showcasing physical stores will be increasingly necessary as a means to broaden awareness of the brand as a whole.

The work done by these retailers exemplifies what can be accomplished when thinking outside the box and taking steps that may traditionally be considered risky.

“Innovation can be convenient or cool,” said Colin Hunter, CEO of Alton Lane during a “Meet the Disruptors” panel discussion at #RIC16. “If it’s not convenient or cool, it’s not worth doing.”

While the “go omnichannel or go home” philosophy may be daunting for retailers struggling just to make their mark in a single channel, there can be a bright future ahead if they trust in their store offerings, hire more digitally-oriented executives and employees, and test out newer delivery models.

Even the current top-performing retailers aren’t immune to competitive forces: far from it. Kasey Lobaugh, Principal of Deloitte Consulting, indicated in his #RIC16 keynote panel that the top 25 retailers have actually lost 2% of their market share since 2009, equating to approximately $64 billion. First and foremost, this indicates that there are companies disrupting the retail environment effectively enough to take revenue away even from the industry’s powerhouses. While this money isn’t going to the big names, it isn’t going away; it’s just going someplace else, said Lobaugh.

Additionally, it shows that these young guns are actually winning over consumers in a way many top traditional retailers haven’t been able to accomplish, creating a better blueprint for how omnichannel retailing can be carried out in 2016 and beyond.