Last week, reports from Tech Crunch and Reuters revealed that Walmart would be investing in a new service to compete with Amazon Prime.

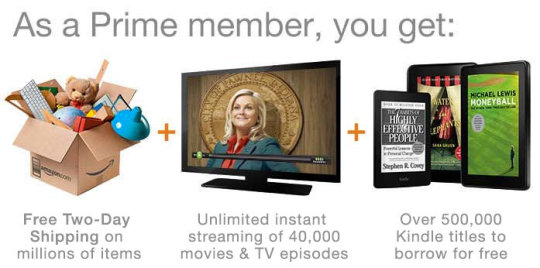

Amazon has a loyal member base that love its two-day shipping guarantee. Not only that, but Prime members also have access to music and video streaming, as well as Kindle rentals. However, Walmart still is banking on the fact that its service will be approximately half the annual fee of Prime.

Is this enough to guarantee success? Will we start to see Prime members abandoning Amazon for Walmart? The RTP editorial team shares their thoughts:

Debbie Hauss, Editor-in-Chief: I don’t see this as a long-term successful program for Walmart. Most people have Walmart stores nearby and like to visit those stores. Amazon’s service is one day faster at this point and offers additional value, such as Kindle books and Amazon music. It’s a great value for regular Amazon shoppers. I just don’t see this as a similar type of value for regular Walmart shoppers. I also question whether-or-not Walmart wants to encourage its regular shoppers to avoid visiting the store? I think a lot of impulse buying happens when shoppers visit Walmart stores and I doubt the retailer wants to forego those cross-sells and up sells.

Alicia Fiorletta, Senior Editor: It seems as though Walmart is attempting to race Amazon to the bottom, much like it does with its other competitors. Rather than trying to play at a game Amazon has already mastered, I think Walmart should focus on perfecting its own business model and optimizing a competitive advantage that Amazon doesn’t have: Stores. After all, the retailer has seen success with buy online, pickup in-store. Are there any additional services or value-adds that could be a good fit?

Rob Fee, Managing Editor: I don’t see Amazon Prime members switching over to Walmart just because it’s half the cost. Amazon Prime’s value to customers has moved far beyond free two-day shipping. The music and video streaming easily justifies the higher cost, and the shipping is still a day faster than Walmart’s. Until Walmart can provide additional value, I it won’t effectively compete with Amazon Prime.

Glenn Taylor, Associate Editor: I don’t see the service undercutting Amazon, but I think it will do well in its own right. Customers are always looking for that cheaper option, which is why Walmart dominates in the first place, so it wouldn’t surprise me to see the system thrive. I think those that are always sticking with Amazon tend to do so because of brand loyalty, so the idea of them dropping the service to a competitor that can’t guarantee better service is unrealistic.

Kim Zimmermann, Senior Managing Editor: I think that Amazon shoppers are loyal due to the selection, convenience and service. They have a big jump on Walmart. Maybe some will switch intermittently if they see a deal but Amazon is not in jeopardy.

Brian Anderson, Associate Editor: It’s hard to think that this program will see a large amount of success. In comparison to Amazon, Walmart has a smaller selection to choose from – and Amazon still has them beat by a day. Also, Amazon offers a variety of other services alongside their shopping/shipping options. While the program might convince loyal Walmart shoppers to stay, I can’t imagine it convincing Amazon Prime members to switch.

What do you think? Will Walmart’s new service be a hit or miss? Share your thoughts in the comments section below!