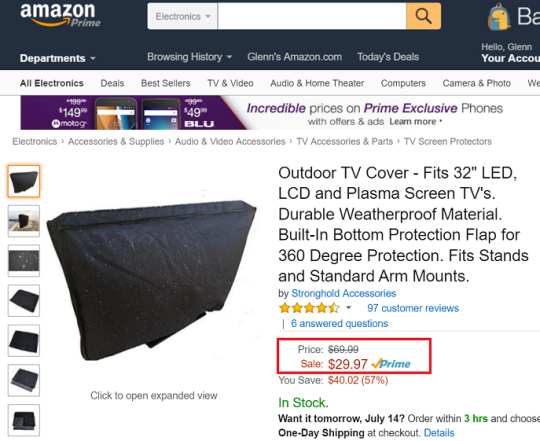

As Prime Day came and went, Amazon once again found a way to dominate the retail (and economic) headlines of the week. But one bit of news regarding the company appeared to be overshadowed even as customers paid for discounted items — the e-Commerce giant is phasing out its “list prices.”

List prices have been a tried-and-true retail promotional tactic, often used as an approach to illustrate a discount on a product that was marked down. With the strategy often subject to criticism despite its success, Amazon has apparently decided to buck the traditional retail trend in displaying just one singular price.

The RTP team discusses the industrywide implications of Amazon’s decision to phase out list prices and mulls over what factors led to the decision. And as with many other Amazon-related discussions, the debate highlights how other retailers can compete with the strategy shift.

Debbie Hauss, Editor-in-Chief: Amazon may be developing much too large an ego even for Amazon. It’s so easy for shoppers to compare prices these days, so maybe if it’s a box of crackers Amazon can get away with eliminating MSRP, but if it’s a smartphone or an appliance I am sure shoppers will take a few moments to find out the price at competitors’ sites. I don’t think even Amazon can expect that shoppers will just naturally assume prices on Amazon.com are cheaper than elsewhere. That said, eliminating list prices does solve other business issues for retail companies — they no longer can get caught in a lie (intentional or not). I guess it can be a win-win for Amazon because if they are selling the item for the best price then the consumer will find out and click back over to the Amazon site to finalize the purchase.

Adam Blair, Executive Editor: This may well be the logical extension of Amazon’s long-term game plan, to “buy” market share with low (or low-seeming) prices while simultaneously making themselves the default shopping destination for millions of consumers. The latter phenomenon has already occurred: Amazon Dash Buttons now offer hundreds of items and are clicked at a rate of once per minute; Amazon Prime membership is 54 million, and will likely spike even higher after Amazon Prime Day on July 12. But I agree with Debbie that the e-Commerce giant may be growing too big for its britches if it thinks it can disregard customers’ price sensitivity, particularly with big-ticket or “hot” items. Many other retailers are poised to take Amazon on, from Walmart on down. I’m waiting for the holiday ads from these competitors, shouting “We’ll beat Amazon’s price!” (Whether they can actually do that, given Amazon’s ability to change prices quickly and frequently, is another story.)

Alicia (Fiorletta) Esposito, Content Strategist: I think the New York Times article brings up an interesting point, that Amazon no longer needs to “seduce” people into buying from them. In fact, there are many research studies, including one from PowerReviews, that say Amazon is a go-to source for shopping inspiration and product information. Because the platform is so top-of-mind for consumers, Amazon can focus on bigger, more strategic initiatives such as enhancing its Amazon Prime offerings and bolstering capabilities for its Echo technology. These projects will have a more significant impact on brand perception, sales and loyalty than simply publishing “list” prices.

David DeZuzio, Managing Editor: One of the best things about Amazon was checking the competing prices and deciding for yourself whether or not it was worth ordering from the retail giant. As a Prime member, the free shipping made most orders a slam dunk, but to be honest, I might start checking out other sites for better prices. I’ve seen better prices here and there but shipping was prohibitive (compared to free). So, obviously anyone who can match free shipping and slightly lower prices (pennies and nickels still count to some!) should quickly find themselves as major competitors to the Goliath of retail. Trying to get customers to blindly trust your pricing is a mistake. Amazon should know this as they’ve more or less convinced everyone that they have the best prices. The levels of trust and loyalty that Amazon have earned are well-deserved and, for the majority of retailers, incredibly hard to come by. But once you earn it, you can’t expect your customers to believe your discount is the best with a “trust us” wrapped up in a single price.

Glenn Taylor, Associate Editor: I believe the customer has definitely gotten savvier when it comes to their desires around retail experiences, which is why Amazon has gotten to its position in the first place. However, I don’t think pricing and the experience itself necessarily go hand-in-hand, especially on major sales days that promote deep discounts. There have been plenty of instances around Black Friday and Cyber Monday, and now Prime Day, where the “sale” price either isn’t a sale at all compared to most days or is discounted very little, and people still buy without doing research and assuming it’s a good deal. If Amazon is so confident that they don’t have to display any list prices anymore, then it shows how well their consumers have stuck with the brand once they’ve made purchases there. Retailers should be competing beyond price points anyway, and if they’re so worried about Amazon only listing one price, then they probably have bigger problems of their own to manage.

Klaudia Tirico, Associate Editor: It is a bit sneaky of Amazon to eliminate its “list” prices, but I strongly believe consumers are smart enough to know that they should be doing some online research before making a big purchase decision on the site. As Debbie said, Amazon can surely get away with it for small, inexpensive items, but not for pricey electronics. The move does seem smart, in a way, with many retailers getting heat for misleading MSRPs. For example, Overstock.com was fined $6.8 million for exaggerating list prices to make customers believe they are getting a deal. It’s a simple solution for Amazon to avoid this type of controversy, so why not, right?