By Scot Wingo, ChannelAdvisor

Amazon recently announced their Q3 2014 earnings results, and surprised Wall Street with more losses than expected. Although the financial results have painted a gloom and doom picture in the press, Amazon continues to thrive from an online seller’s perspective.

It’s easy to read the headlines and think that the wheels are coming off the Amazon bus, but the results that matter for sellers actually show that Amazon’s 1st Party (1P) and 3rd Party (3P) businesses are doing quite well. The problem areas for Amazon are in media (which grew only 4%) and non-seller oriented areas, such as the Fire phone.

There was a lot to process from Amazon’s Q3 results, but here are a few key points that are especially important for sellers to focus on:

Areas Of Growth

The most impressive metric was the acceleration of the Electronics and General Merchandise (EGM) product category – which most 3rd Party sellers fall into. EGM accelerated in North America, increasing from 29% to 31%, making it more than two times the growth of e-Commerce.

Additionally, the number of active users on Amazon grew 16% year over year to 260 million, in-line with Q2’s 17% growth rate. These active users also bought more frequently with the “units per user” up 5% over last year. This remarkable increase indicates that programs like Prime, Amazon recommendations and upsells are working.

Areas Of Improvement

As previously mentioned, media share was one of the weaker areas of growth for Amazon with only a 4% increase over last year. Media’s share came in at 25% of net sales with EGM at a high-water mark of 68% and the remaining 7% coming from other streams of revenue, such as ads and Amazon Web Services.

Also, the 3P unit only saw a slight uptick from Q2’s 41% to 42% in Q3. While this may not seem like a big move, the interior math tells us that 3P Gross Merchandise Value (GMV) grew 30% y/y compared to 1P GMV which grew at 19%. GMV measures the value of merchandise sold on an online marketplace.

Areas Of Comparison

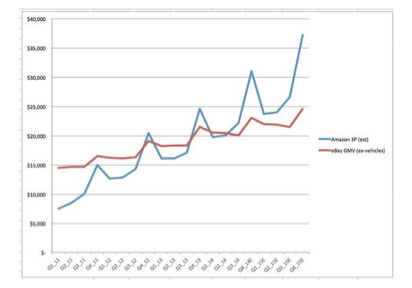

In the chart below, you can see that Amazon’s 3P GMV was greater than eBay’s for the first non-Q4 timeframe since ChannelAdvisor has been tracking Amazon and eBay GMV. If Amazon maintains this trajectory, and eBay does not accelerate unexpectedly, the lines have crossed for the foreseeable future. This means Alibaba will take the title as the world’s largest marketplace, with Amazon in second place and eBay in third.

Below are a few additional new data points from Amazon’s Q3 earnings that were relevant to sellers, including:

- Amazon forecasted Q4 total revenue growth to fall within the 7% to 18% range. The current midpoint growth is projected at 12.5% and suggests a tough holiday outcome for Amazon. Taking into consideration that both ComScore and Forrester are forecasting 15%+ growth for the holiday season, any lackluster results in Q4 will be due to slow growth in the media category and tough regions like Japan and China.

- As of Q3, Amazon’s geographical mix for the quarter was 63% North America, 37% non-domestic.

- Amazon continues to expand its network of fulfillment centers (FCs) and highlighted that they built 13 net new FCs this year and an additional 15 sortation centers to streamline the process of order fulfillment and delivery.

Conclusion

From a seller’s perspective, this was a strong quarter for Amazon, with the North American EGM sector accelerating and solid international EGM results overall. Although the growth projection for Q4 is lower than expected at 12.5%, we’ll have to see if that is conservatism or a true concern for the fourth quarter.

As CEO of ChannelAdvisor, Scot Wingo leads the company in its mission to provide retailers and manufacturers with the software and services needed to successfully sell their products via online sales channels. In tandem with his work at ChannelAdvisor, Scot is an industry thought leader, contributing regularly to several ChannelAdvisor blogs and speaking often at industry events. Scot received a Bachelor of Science degree in Computer Engineering from the University of South Carolina and a Master of Computer Engineering degree from North Carolina State University. Scot has received numerous awards including Ernst and Young’s Entrepreneur of the Year and Triangle Business Journal’s Businessperson of the Year.