By Franklin Chu, Azoya USA

For a preview of where retail is headed, retail companies in the U.S. and

other Western countries can look to China’s booming market.

Pervasive social media platform WeChat has

attracted an astounding 1 billion daily active users. The platform

signifies seamless, unified and convenient omnichannel retail service. That’s

because it integrates product search, influencers, social commerce and mobile

pay, plus WeChat is growing its e-Commerce ambitions with the booming Mini

Program.

Learn how WeChat

represents the future of retail — and how foreign retailers and brands can win

by using it.

On June 29, after just three years of operations,

upstart e-Commerce platform Pinduoduo submitted an SEC filing to go public on

the NASDAQ stock exchange. A relative newcomer to the Chinese e-Commerce industry,

Pinduoduo now boasts nearly 300 million registered users and generated more

than US$30 billion in GMV in 2017. Its meteoric rise has stunned industry

insiders and forced traditional players such as Alibaba and JD.com to reexamine

their own business models.

Core to Pinduoduo’s success is its social commerce

approach and its leverage of WeChat’s mini-program function, which Internet

giant Tencent rolled out at the beginning of last year.

What Is

Social Commerce?

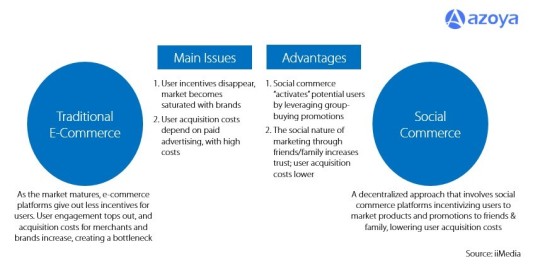

Social commerce is an evolved form of e-Commerce,

in which platforms rely on current users to “activate” potential users by

sharing promotions and items with them, essentially decentralizing the user

acquisition process. Users are incentivized by steep group-buying discounts and

game-like campaigns that make sharing fun and interactive. In the U.S., brands

may give discounts to customers who share via email, Facebook or Instagram, but

the single-function nature of Facebook News Feed, Facebook Messenger, and

Instagram makes the process less interactive, so social-based commerce still

hasn’t taken off in the U.S. like it has in China.

A prime facilitator of social commerce in China is

WeChat, specifically its WeChat mini-program function. Approximately 65% of

Pinduoduo’s transactions are completed through its WeChat mini-program, which

enables users to share products and make purchases without having to switch to

another app. Mini-program pages are limited to a size of 1mb each and integrate

with WeChat Pay so users can carry out transactions quickly. Users in smaller

cities tend to use cheaper phones, so mini-programs are better suited for this

user base.

For example, on Pinduoduo, a merchant may offer

two prices for, say, a rice cooker. It could be priced at 300 RMB ($45 USD) for

individual customers, or at 200 RMB ($30 USD) for customers that pull in

another user to make a purchase, also for 200 RMB ($30 USD). This promotion can

be shared on WeChat with another friend or family member, thus reaching a potential

customer who didn’t intend to purchase a rice cooker in the first place. This

strategy has proven to be especially effective in smaller Tier 3 and 4 Chinese

cities, where users are more price-sensitive and make less frequent purchases.

Social

Commerce Resolves Pain Points For Merchants In A Saturated Market

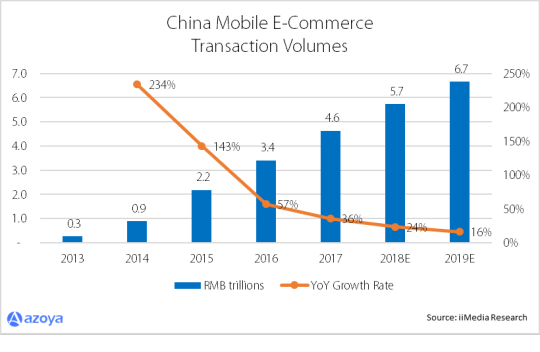

Social commerce has provided a solution to

bottlenecks that have arisen from slowing e-Commerce growth in China. With

traditional e-Commerce, users generally log on to a platform with an existing intent

to purchase a certain product or brand. The search function plays the core role

in connecting users with products, and merchants pay to access user traffic

through ads or discount promotions. However, as more and more brands sell

products through marketplace platforms, the market becomes increasingly saturated

and traffic becomes more expensive to access as brands bid up advertising

costs.

Social commerce provides a remedy to this problem

by opening up a new, decentralized avenue in which customers can discover

products through trusted friends and family. Since China e-Commerce is rife

with cases of fraudulent and shoddy goods, many consumers have grown to suspect

the authenticity of online products. Customers are much more likely to purchase

goods recommended by family and friends, and WeChat is instrumental in

facilitating the sharing process. 50% of Chinese customers are willing to

purchase products recommended by friends and family, according to a report on

cross-border e-Commerce by Frost & Sullivan and Azoya Consulting.

In addition, international brands and retailers also

can set up their own WeChat mini-programs and create unique campaigns and promotions

with which they can build customer loyalty. This may finally even the playing

field between brands and marketplace platforms, which raise the bar higher and

higher for brands who want to list their products on them.

Why U.S. Retailers Should Care

Pinduoduo is a prime example of how social

commerce, facilitated by WeChat mini-programs, is revolutionizing the

traditional e-Commerce industry by changing the way brands and consumers

interact with each other. Going forward, e-Commerce will become more

interactive and an ever-present aspect of Chinese social media. As U.S.

retailers continue to struggle in the face of falling foot traffic and

increased online competition from the likes of Amazon, they need to devise new

ways of connecting with their end customers. Infusing a social element into

one’s e-Commerce strategy could be just what they need to revitalize their

online business, and the way Pinduoduo has been able to do this in the China

market provides a useful example of how retailers can do this.

Franklin Chu is Managing Director U.S. for Azoya USA, a provider of turnkey cross-border e-Commerce solutions to

assist retailers looking to expand into China through a cost-effective and

lower risk method. To date, more than 35 retailers in 11 countries are

partnering with Azoya to expand into China with ease, including French fashion

retailer, La

Redoute, Australia’s largest

pharmacy group, Sigma, Europe’s largest online beauty retailer, Feelunique, and United States premier retailer of juvenile products, Babyhaven.