By Traci Gregorski, Market Track

Apparently shifts in weather patterns have thrown yet another curve ball to the traditional retail industry.

As earnings reports from the 2015 Holiday Shopping Season were released, many retailers who fell short of expectations pointed to unseasonably warm winter weather for their poor sales result in the cold weather categories. This was in addition to the already beleaguered retailers who are battling new entrants into the e-Commerce space in the form of Jet.com, as well as increased traction by Amazon. Of all things, they now have to deal with unpredictable seasonal temperature patterns.

Winter clothing sales have taken a hit from record high temperatures in the U.S., according to industry reports — a stark contrast from last year’s outerwear frenzy. Retailers like Macy’s, Kohl’s, and Gap all felt the effects of an extremely warm start to winter, leaving them trying to push unsold inventory early in 2016, before the calendar turns to spring. The change has carved a chunk out of retailers who rely on the weather for clothing sales.

Apparently cold weather-related apparel declines have been just as obvious online as in-store, with data indicating a strong drop-off in winter clothing sales in the past months. But before assigning full blame on the weather, consider this…

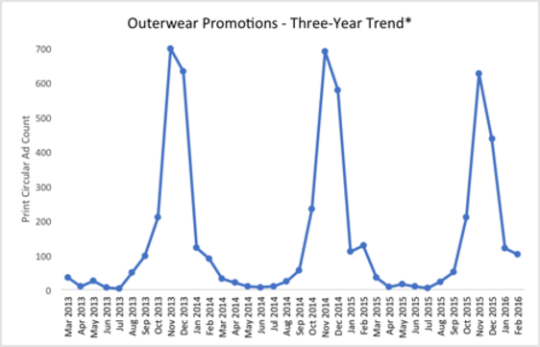

The reality is that consumers traditionally get new winter wear before the first snowflakes fly, so the warmer weather really cannot carry the entirety of blame for lackluster sales results. As such, a large part of the blame for decreased sales should point at the decrease in the amount of promotions around outerwear over the past three years. It most certainly has been a major driver in the overall sales decrease of the category, as seen in the chart below:

Over the past 36 months (from March 2013 through February 2016), total outerwear promotions have decreased by 4% between March 2013 to February 2014, and March 2014 to February 2015. An even sharper decline was seen over the past 12 months, when retailers decreased total outerwear promotions by 14% from the previous 12%.

It is clear that the lack of predictability in weather patterns means that past approaches to timing and cadence of promotions for outerwear simply may not work. The changes require a more strategic approach to driving traffic and sales of outerwear products. Providing compelling promotional incentives earlier in the year that propel consumers to make that trip to the store — well before consumers know how cold their winter will be — could make or break retailers’ chances of moving seasonal merchandise, and avoiding deep discounting at the end of the season.

Getting an early start on the promotion of cold weather gear can wrest the control out of the hands of Mother Nature, and put it back into retailers’ hands. As the 2016-17 selling season approaches, retailers would do well to plan the merchandising and promotion of outerwear categories early in the season, for it would certainly hold at bay the frustrations of October and November 2015.

*Market Track Methodology: Reviewed circular advertising (# of circular ads) for the outerwear category between March 2013 and February 2016 from JCPenney, Kmart, Kohl’s, Macy’s, Sears, Target and Walmart.

Traci Gregorski is Senior Vice President of Marketing of Market Track, a leading provider of subscription-based advertising, pricing and e-Commerce intelligence solutions. Over 1,200 clients leverage Market Track’s competitive insight into print, digital, broadcast and e-Commerce to optimize their advertising strategy. Prior to joining Market Track, Gregorski worked with Fortune 500 companies in developing integrated content programs for a diverse group of B2B, financial services, association/nonprofit, retail and manufacturing clients. She can be reached at tgregorski@markettrack.com.